Before there is Ideal, there is Early (Customer Profile)

Lessons learned from 400+ launches

Dear GTM Strategist!

You are probably familiar with the Ideal Customer Profile (ICP)—the concept of your perfect customer, who has deep pockets and is just waiting for your product to ship.

The problem is that we don’t live in an ideal world. There is a road to your ICP; the shortest one is taking a deep dive into your early customers first.

Ever since my Go-to-Market Strategist book launched in November, the concept of Early Customer Profile (ECP) has been a hot topic on LinkedIn, in Q&A sections of online events, and many other content creators have provided their takes on the concepts. ❤️

If you google “Early Customer Profile”, you will be disappointed. Even though ECP quickly won the hearts and minds of readers, there is little to no actionable literature on “Early Customers”. It is easy to grasp that before “ideal”, there is something else, but mental models of how to choose the right bets, actionable tools, and recent examples are missing.

Enzo Avigo, co-founder and CEO of June.so analytics solution, explained on the GTM Strategist Podcast (listen here):

“Our first users were indie developers, and it was nearly impossible to monetize them. Business finally took off when we pivoted to target established B2B SaaS companies.”

Bingo!

User ≠ Customer.

The concept of a customer includes money transactions 💰. You can get thousands of users from Product Hunt and whatnot, but that does not necessarily mean that you are closer to product-market fit, which in my book also includes building the foundations of a sustainable business model. It is called the Product-Market Fit Cycle.

This is why today, I’ll reflect on lessons learned from more than 400 launches I have participated in. Together, we will embark on the mission to discuss examples, develop understanding, and discover some tools to help us confidently make ECP decisions.

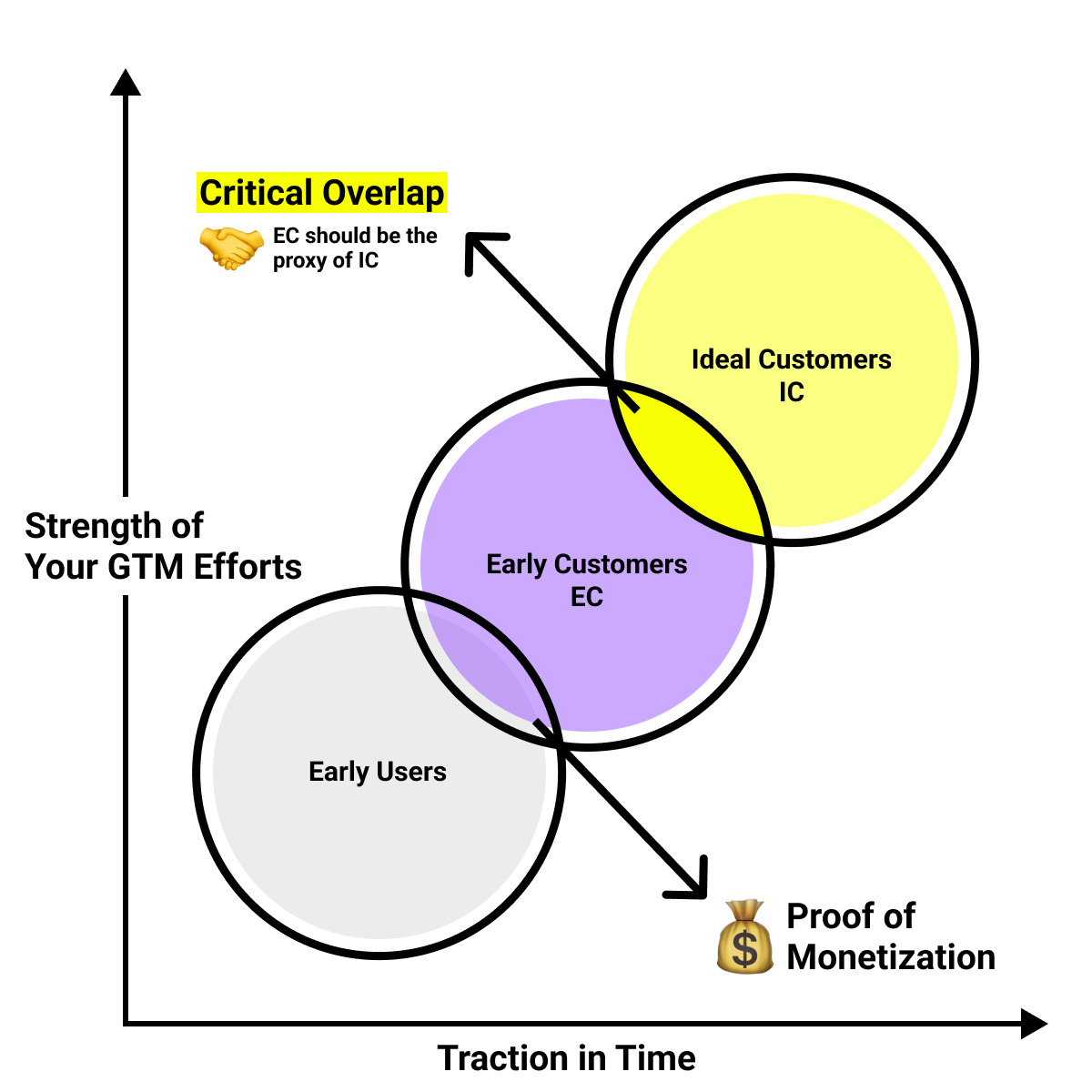

ECP should not “just happen”. It should be a proxy of ICP.

My primary reason for writing about ECP instead of ICP (Ideal Customer Profile) in the Go-To-Market Strategist book was that before you can win your “ideal customer,” you have to make peace with the fact that, more often than not, you will have to work your way up the market to get there.

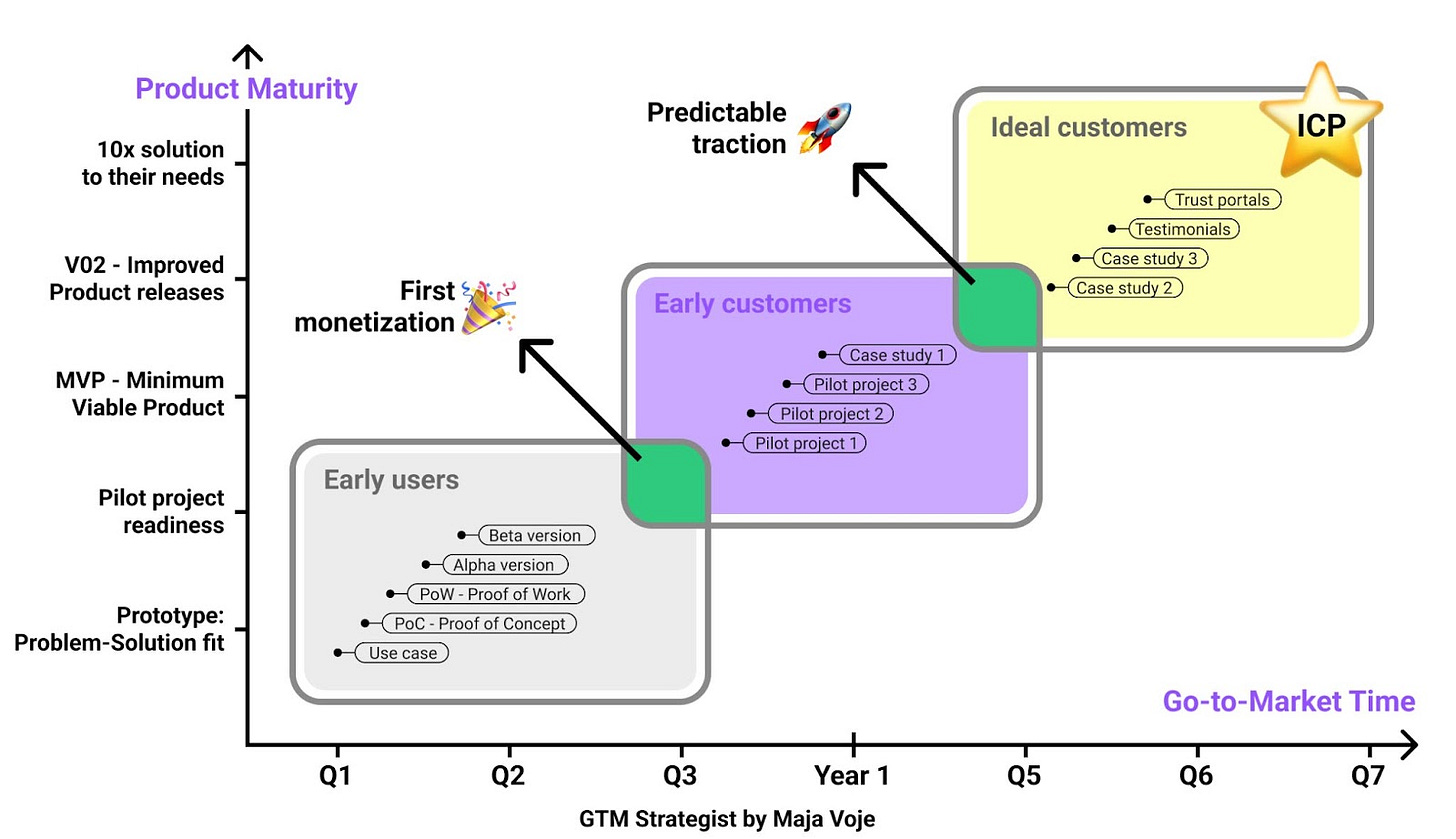

Confidence comes from relevant evidence. Before your ICP has the confidence to work with you, your ECP will have the enthusiasm and courage to help you provide evidence that you can deliver value predictably and repeatedly. You need to compile a critical mass of relevant satisfied customers. This is most often done by snowballing the pilot projects to enter new markets (geographies, industries) or win higher-up decision-makers or clients with larger budgets.

My big ideological fight with “test and learn” is that we should be proactive and intentional instead of reactive to random market insights. Sure, you can go out there, do something, and reverse-engineer a sub-segment that converts and retains well and attracts more customers like them.

But the devil is always in the details:

Are you sure you attracted the right type of audience in the first place?

Was the messaging and product experience purposefully tailored to deliver 10x for them?

Should you pivot to a different target audience (aka ICP) if the first couple of tests did not confirm your hypothesis or were invalid?

The answer is no. Target market decisions should never be taken lightly because you will have to live with them for at least a quarter ahead. The selection of target market determines all other elements of the go-to-market strategy (product, positioning, pricing, and the right growth motion). Dismissing this decision with a couple of tests or scattered poorly executed launches is a danger zone, a route to chaos.

Your true north is your objective, but your go-to-market strategy also comes from business vision and strategy and a servant of product vision. Therefore, your go-to-market strategy should remain a purposefully developed blueprint to an objective instead of a path of breadcrumbs of “market insights”. Make an informed decision and stick to it before you collect a critical mass of evidence.

You will need relevant evidence that your solution really works (case studies, testimonials, use cases, working prototypes, trust portals, building playgrounds) - a little bit like this:

It does matter a lot which ECP you choose because “alike attracts alike”. Ideally, there is an intercept of ECP and ICP so that ECP use cases are relevant and attractive to the final ICP. Your job to be done is to sell “more of the same/similar use cases” and get closer and closer to your ideal customers.

Therefore ECP does not mean that you are first “stuck” with technology enthusiasts who spend 6 hours a day in some niche communities, jump from one “shiny new thing to another,” and have a low to non-existent willingness to pay for your solution.

The question remains - How can you choose your ECP better?

5 Archetypes of ECPs: From Technology Evangelists to Agents of Change

A common misconception regarding ECP is that first, you must win the “SMB market” before pursuing bigger businesses. I will aim to prove that ECPs come in all shapes and sizes—firmographics/demographics can be very irrelevant. The Early Customer profile is a mix of Behavioral, Jobs to be done, and Psychological characteristics.

We establish the agreement that best ECPs are a proxy of ICP. Imagine two avatars:

CMO Martina guards a 12 million marketing budget, manages 70 people, and works with 12 agencies to complete the job. Every agency delivers a different type of report, and it is hard for her to grasp the whole picture. Yet social media is not her core priority, and she will “do it when there is time.”

Kim is a LinkedIn-famous freelancer eagerly exploring AI-driven solutions to create automated reports for her clients because she hates doing them manually and wastes 8 months preparing them.

In most cases, you will likely have to win Kim (ECP) before winning Martina (ICP). Kim is already exploring the solutions and has a burning pain point and high-risk tolerance. Martina knows that she should act upon this, but it is not her core priority.

But the question remains - is winning Kim helping us get closer to Martina? Yes, if Kim is relevant to Martina.

In her micro-universe, Kim is an “opinion maker” - she posts regularly on social media, does lectures on how to win new traffic organically for leaders like Martina and Kim will eagerly share her new automated reports on social media, while if you ask this from Martina, she would have to go through compliance department in another company. Will Kim’s case be enough for Martina? Probably not, but if Martina sees that also other “social media moguls” like Marco, Natasha and Peter start using a new AI-first social media reporting tool with sentiment analysis, she or her team will repeatedly see it and start considering it.

But how “far away” should ECP be from ICP?

Are you working from “small towards big”?

Often I get asked: can I target “big corpo” directly?

Yes, you can. Often times when I work with founders, we “go big or go home straight away” so that we do not miss out on the window of opportunity nor leave the money on the table. Such an approach works well if:

Stunning new technology solution, which is not 10x, but 100x better

You are an early solution to a market with a burning paint point and can barely meet the demand.

When you have proximity and access in the segment (you actually know decision markers there and speak their language)

Pre-existing traction and evidence that make us a “go-to” solution for X. You can piggyback on your previous experience in satisfying the lucrative segment.

Let’s share some examples. This is how some teams I worked with got the first 5 BIG accounts without breaking much sweat by doing small incremental use cases:

ESG tool: The team built a demo, posted a couple of posts on social media, and got a HUGE pipeline of corporate opportunities because everyone (in Europe) is freaking out about this legislation change. The product was 10x because it was interactive.

Trusted traceability solution: Within months, the first pilots were secured through founders’ networks, events, partnerships, and co-creation with innovation centers.

HR tool for employee satisfaction: It was immediately clear that if we want to “be in green,” we need to onboard companies with a lot of employees; otherwise, we will be too slow. The team attended many HR conferences and integrated into HR communities to access those whales.

AI LLMs solution: Instead of grinding through communities, we pitched (via personalized cold outreach!) to Chief Innovation Managers of regional financial institutions - the average seal size was 30K a year.

I went back and searched for patterns in my portfolio of over 400 product launches. I did some pattern-recognition heavy lifting, and here are the 5 Archetypes of Early Adopters that I have repeatedly seen on my go-to-market journeys. I presented them as Yu-Gi-Oh cards to make it more fun for you to learn.

Let’s start with the Tech Enthusiast…

…and continue with the gentle and well-intended Underdog Supporter.

Now, what about the Game Changer?

It’s getting hot in here! Here comes the Digital Transformer.

And here’s your final boss:

Do any of those look familiar to you? 😇

OK, by now, we have a rock-solid understanding of the ECP nuances.

Early Customer Profile - ECP Archetype

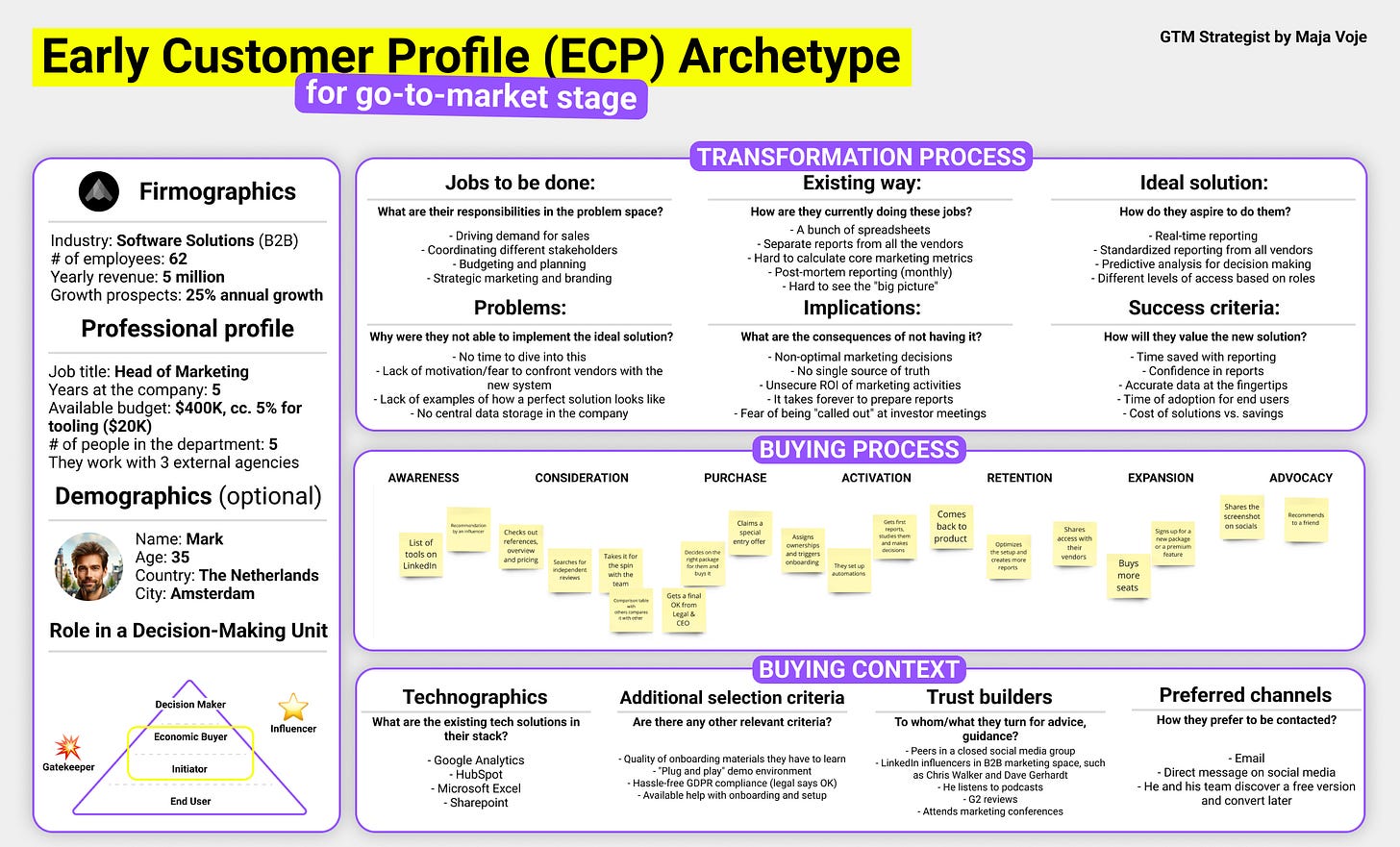

When we are searching for an Early Customer Profile, we gravitate toward shorter sales cycles, high pain levels, relatively high willingness to recommend, and tolerance for “imperfect” products. We usually agree on an “early adopter deal” and compromise on price a bit to create frequent and informative feedback loops for our product and gain first-paid references, social proof, and recommendations.

We said previously that the demographics and firmographics (company size, revenue, etc.) do not play a crucial role in the first iteration, but I still recommend putting a proxy of these parameters in your Archetype based on your experiences so that the ECP is more applicable (building target list, targeting for advertising, ease of communication to other stakeholders.

This is an example of an Early Customer Profile for an AI-first reporting tool for marketing teams. Here is a general template (with an example) I created. You are welcome to adjust it to your needs and liking.

ECP is best defined as learning by doing: Take your hypothesis for a spin

Now that you have your ECP hypothesis ready, it is time to throw it against the wall and see what sticks. People say many things in interviews and on social media. What matters more is if you can find a group of early adopters to:

Passionately start engaging with your content

Take your solution for a spin

Experience the wow moment of it

Adopt it to their workflows

Recommend it to others in their community/network, and look cool doing it.

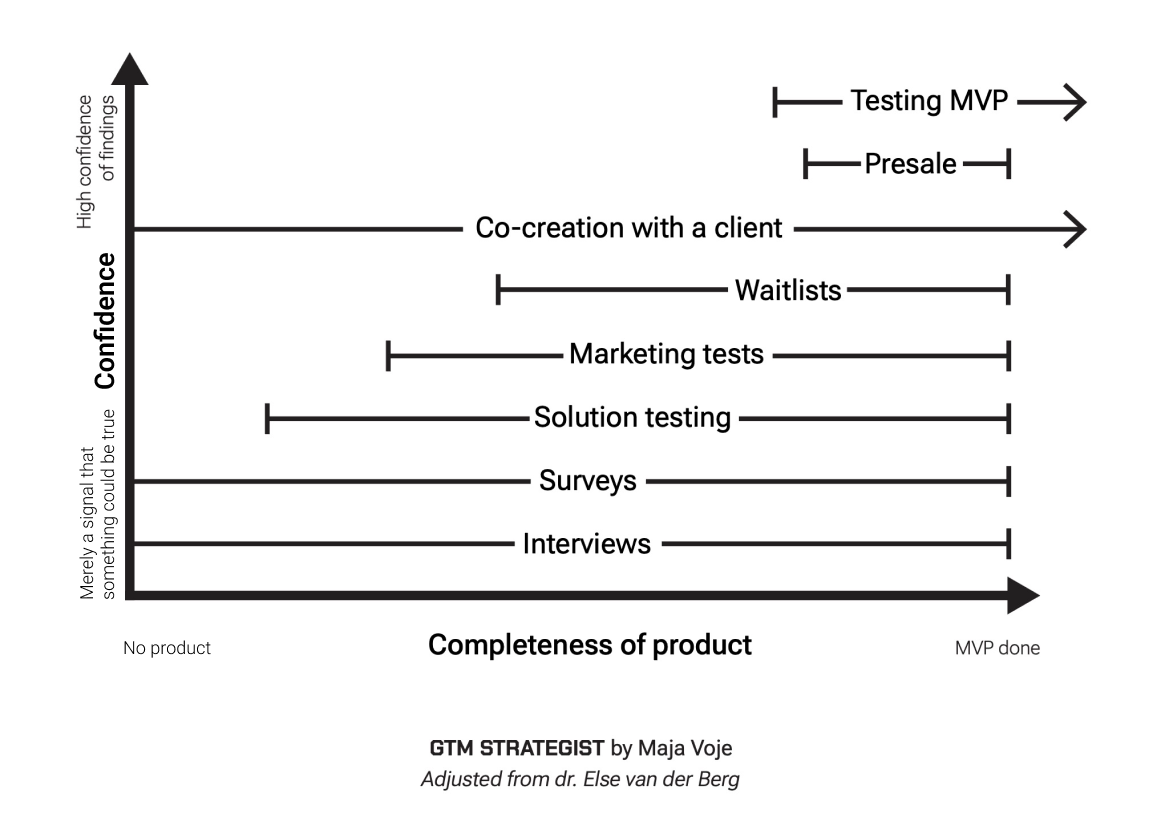

This is why we always prefer “doing” to “saying” research methods when researching early adopters. We usually use the methods to test ECP in the higher confidence spectrum. We prioritize “doing” and fast feedback loops. Here are my go-to-market networks and how I usually like to validate the ECP hypothesis:

Ask your network, VC, partner, etc., if they know anyone who is already working in the space. A warm intro works wonders. Since you are new to the market, the mates you are asking for recommendations from will automatically lean towards early adopters because their good name is at stake, too, when making this intro.

Make a contact list of potential early adopters and use outbound or account-based selling/marketing to secure a meeting with them. Avoid generic “let’s go through the menu, and I’ll show you all the features” demos. They suck and bore the s*** out of an early adopter who is passionate about solving their problem, not spending 30 min on a call with a person they do not know.

Post an invite to beta or launch announcement in a relevant social media group for ECP. Do you reach which groups are relevant to them and test the announcement/messaging with some people before you broadcast it to thousands? I dug up this example from my archive to make it a bit easier for you ❤️

Set up a waitlist with ECP indicators (do you have experience setting up, how many people are actively working on this in your team, what tools do you usually use to solve this) and calculate the ECP fit based on admissions.

Preorders and co-creation of the product with a client. In many cases, early adopters are willing to pre-buy solutions that they are excited about. What matters next is communicating constantly with them and fulfilling the promise.

Once you win their hearts and minds, early adopters are willing to wait for months (in some radical cases years) to get their hands on the solution. But only after they believe it would or will work well for them, and it is a really 100x solution to a burning pain point.

I mentored a team that developed an alert and preventive system for children who suffer from sensory hypersensitivity and could experience a seizure if they are not protected from disturbing triggers. These children have difficulties in their education and socialization process. There are reliable solutions out there. Some parents even sell their real estate to help their kids and finance research in the fields. A solution for them would be life-changing. They will wait for the right solution and closely work with companies to get there.

This is not the case if you are a “good to have” solution or something. If you work in a more cluttered space, you should know the “need for speed”. The window of opportunities is closing fast. Your savvy early adopters with a burning pain and a wandering eye for new solutions are unlikely to wait around long. Their enthusiasm will wear off. You need to act fast and decisively. Timing is everything. Engage them as soon as possible and frequently update them on your progress.

Example 1: Here is how I created a contact list and messaging for testing a group of early adopters - Chief Marketing Officers who are open to customer-engagement AI technologies to test a group with an offer. The demo is a proxy of a real case of finding Enterprise ECP that I am handling now. I used the Clay data enrichment tool to do it.

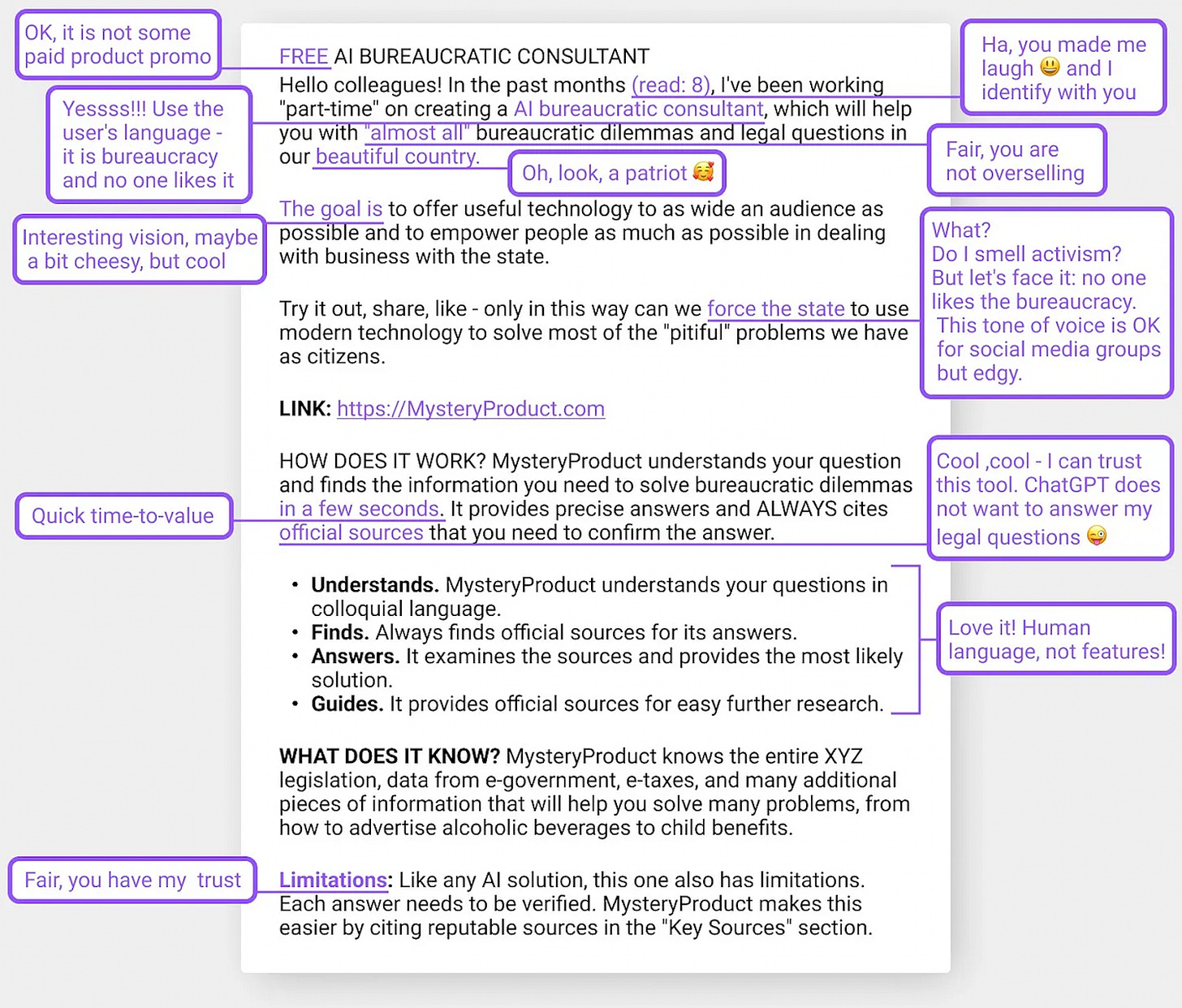

Example 2: This is a translation of the post that an indie maker posted to a couple of local social Facebook groups and got 1000 free users for this AI Bureocratic consultant solution.

I hope that you are one step closer to fully understanding and appreciating Early Customers after reading this Substack post. If you have additional questions, I am happy to discuss them in comments, reply to this email or send me a DM on LinkedIn.

Remember, when you nail the Early Customer profile, you work up the market. If you are servicing a large market, being laser-focused on your early customers can bring you beyond 1 mio ARR. The concept is also extremely useful for new launches of established companies and provides a great antidote for FOMO that could distract the focus. In the words of Highlander …

Thanks for reading, and let’s go to market!

Maja

📘 New to GTM? Learn fundamentals. Get my best-selling GTM Strategist book that helped 9,500+ companies to go to market with confidence - frameworks and online course included.

✅ Need ready-to-use GTM assets and AI prompts? Get the 100-Step GTM Checklist with proven website templates, sales decks, landing pages, outbound sequences, LinkedIn post frameworks, email sequences, and 20+ workshops you can immediately run with your team.

🏅 Are you in charge of GTM and responsible for leading others? Grab the GTM Masterclass (6 hours of training, end-to-end GTM explained on examples, guided workshops) to get your team up and running in no time.

🤝 Want to work together? ⏩ Check out the options and let me know how we can join forces.

There is so much gold in this!! Especially in the recognition of the most critical steps needed before landing on a ‘firm’ ICP.

Great stuffs. You mentioned crossing the chasm by Geoffrey Moore in the other comment, I am assuming your concept of early user and early customer ECP are those within Innovator & Early Adopter segments of Innovation Diffusion?

If yes, I would like to add that “beating the drum together” with EU & EC will bring the crowds from Ideal Customers Segment aka Early Majority. I would add “beating the drum” more than what you added testimonials.

Thanks for your work. Luv it.