Lead Scoring in 2026: From Static Scores to Signal-Based GTM Systems

How top GTM teams decide where effort goes when everything looks important

This newsletter is kindly supported by Attio - the AI-native CRM built for modern GTM teams. If you’ve ever battled a rigid legacy CRM, Attio fixes that with clean data, real-time visibility, and workflows that actually speed you up.

Today, 5,000+ fast-moving companies rely on Attio’s flexible data model, modern design, and builder-friendly setup to shape their CRM around how they work - not the other way around. It’s built for founders, revenue ops, and GTM teams who need a system that adapts as fast as we do.

So if 2026 is the year you finally break up with your legacy CRM or start fresh on a new project, this is the perfect moment to take Attio for a spin.

Dear GTM Strategist,

If you still assign points to “leads” that open your newsletter and register for your webinars in the age of AI-first GTM, you are still lead scoring like it is 2006.

The symptoms of not having or having an outdated lead scoring problem are:

Calendars packed with shit lead to demos 🧟 that make you question “what is the meaning of it all” 5 minutes into the meeting

Constant quarreling between marketing and sales, why “hot leads” that downloaded the latest e-book about 2026 AI Trends are not responding to emails, and

Waking up in the middle of the night in cold sweat, wondering where your next deal is coming from.

Lead scoring is rarely top of mind for most people - most would treat it as “set it and forget it test” - but it is more relevant than ever.

How so?

GTM got harder. Teams are drowning in data, signals, and noise, making it extremely hard to make sense of it all, while being constantly pressured to do more with less, faster than ever.

AI search modes have made customer journeys blurrier and even led us to question: Is something a human or an AI touchpoint?

Meanwhile, barriers for competitors have gotten even lower and customers pick who deserves their attention.

And in this world, your ability to focus on the best opportunities and do prioritization well has become mission-critical.

And lead scoring is a part of the solution - so in this edition, I’ll take you on a journey across all levels:

What is lead scoring, and what is not

We'll create a lead scoring system that captures fit, behavior, timing, and revenue potential

We’ll do some lead scoring workflows in Attio so you can see the system in action

Lead scoring helps us decide where to invest GTM effort to most likely yield strong results.

Note: This guide focuses on inbound lead scoring - evaluating prospects who have already engaged with your brand through website visits, content downloads, or product trials. If you're doing outbound (scoring accounts before first contact), you'll need to prioritize fit and external company signals over behavioral data.

What Lead Scoring Is (nobody said it that simply) 🤠

I love to think about it as “working backwards” from your ideal clients - those who buy fast, stay long with you, and expand profitably.

Imagine your perfect buyer. Better yet - show me their LinkedIn profile. Let’s suppose his name is Bob. He’s been a customer for a year.

Now, look at the digital breadcrumbs Bob left before he signed the contract - as well as firmographics:

When did he first visit the website?

Which webinars did he attend?

How many times did he visit the pricing page?

How big is his company (in terms of employees or revenue)?

Lead scoring is simply the process of finding “Bob” that are already hiding in your CRM - and spotting them early on.

Instead of treating every lead as equal, look for those specific signals that Bob gave off. When a new lead matches Bob’s patterns, their score goes up.

You want to attract more “Bobs” to your business - now let’s figure out what signals will enable you to find Bobs early on and focus your efforts on making sure that they have the best possible experience with your company.

It is a very simplified logic, but this is how every founder I work with can understand that lead scoring is not a “coz I told you so” chore, but a helpful tool to help teams make better decisions about where they spend their time and where to put more $$$.

How it looks in practice:

What else do the teams I work with like?

Math and causation/correlation riddles 🧩

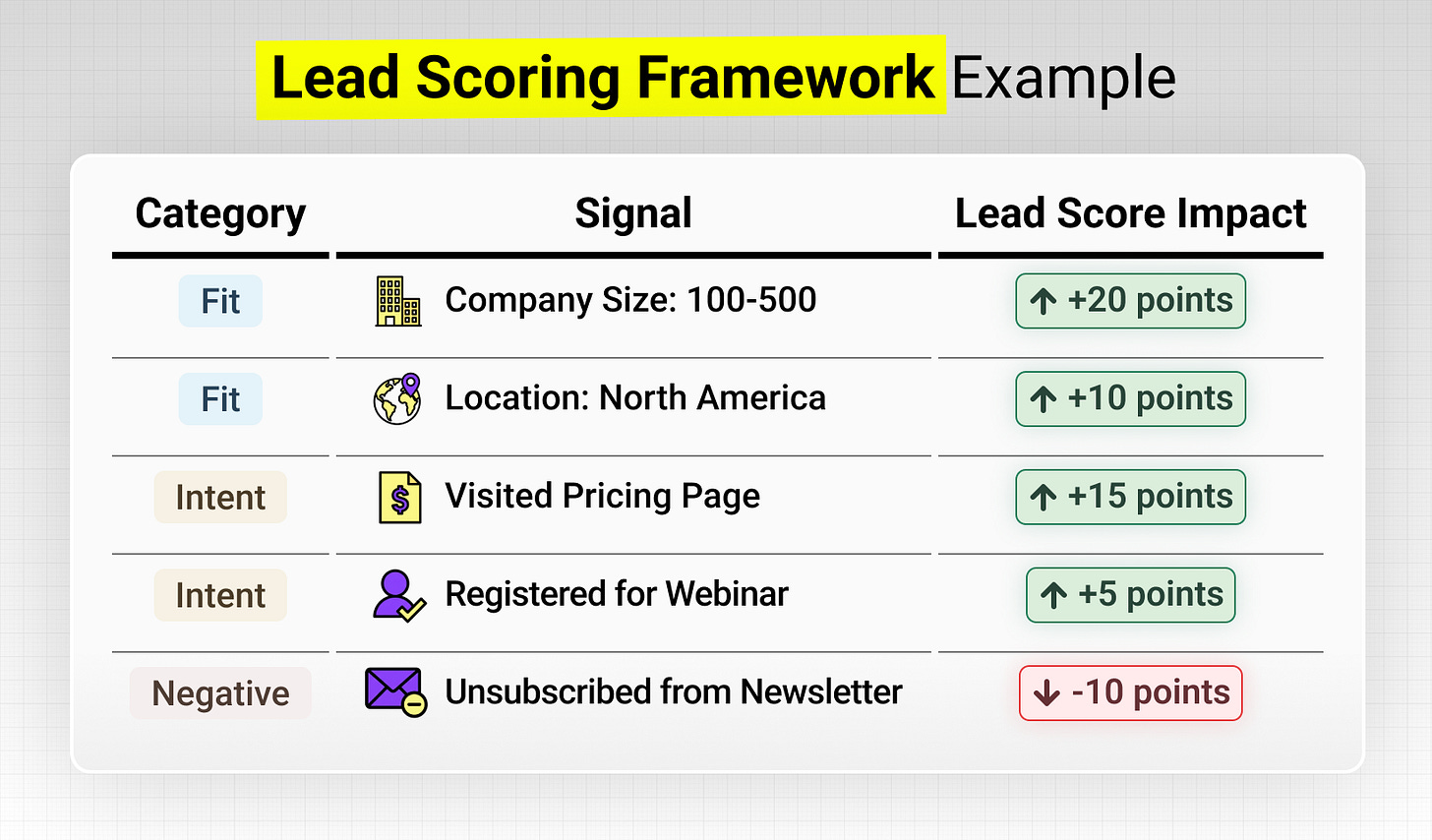

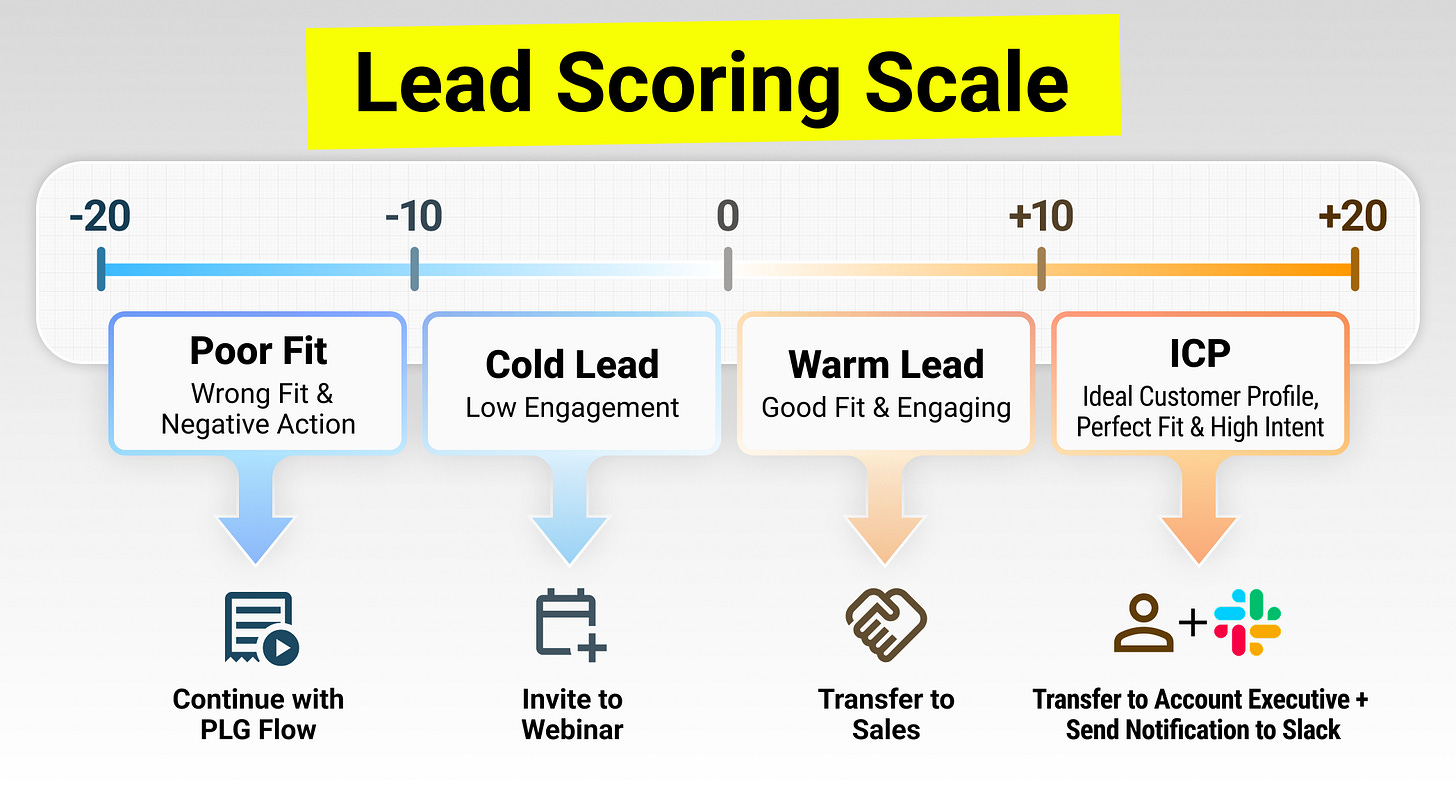

So you can use lead score calculations to attribute “Bobness” on a spectrum from a shit lead that you would be wasting time with (pardon my French - non ICP) to a full-fledged perfect customer that deserves all your loving care and attention.

Very nice! Now that we understand the core logic, all we have to figure out is how to tweak this equation to build a powerful Bob detection tool. 🔎

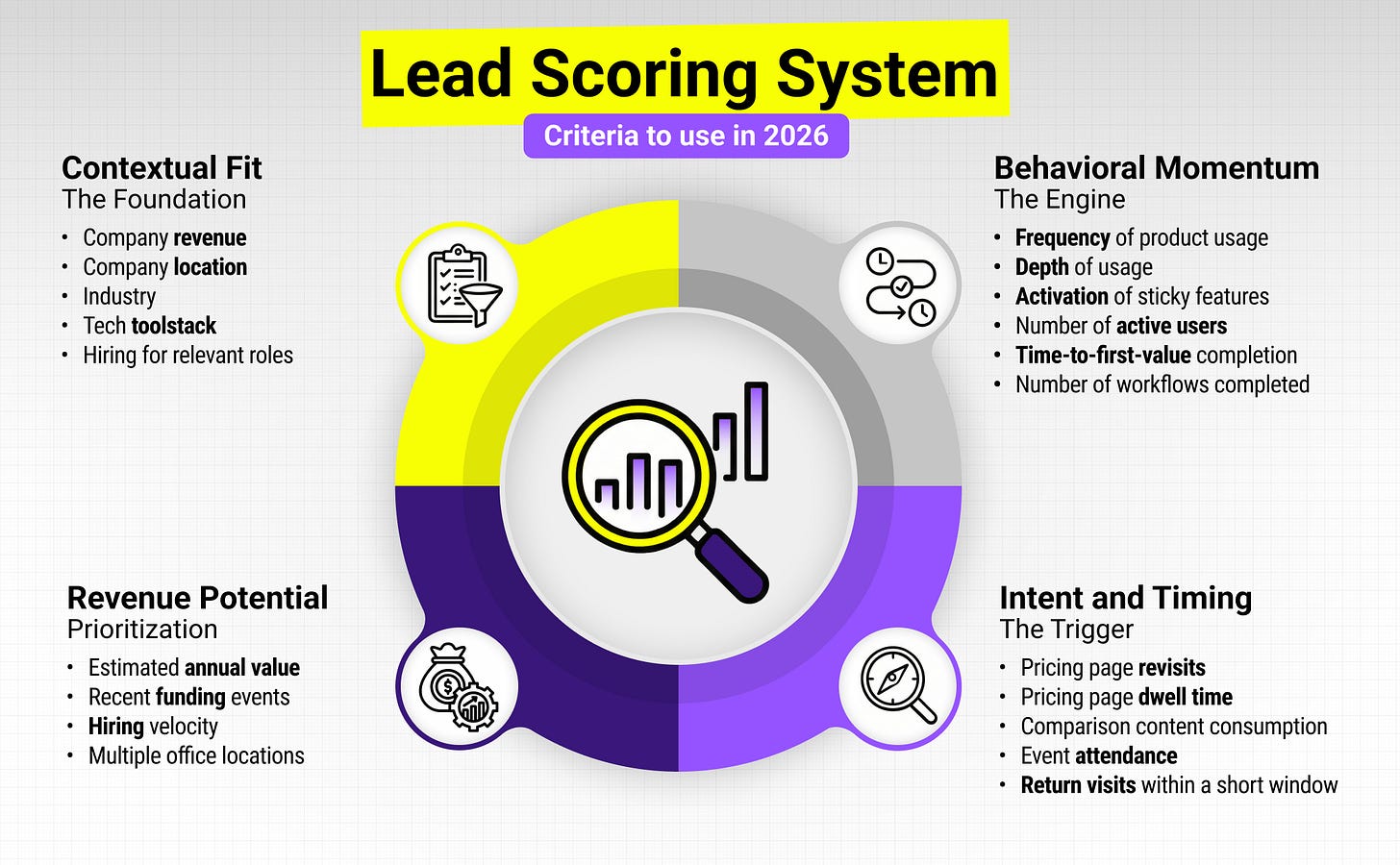

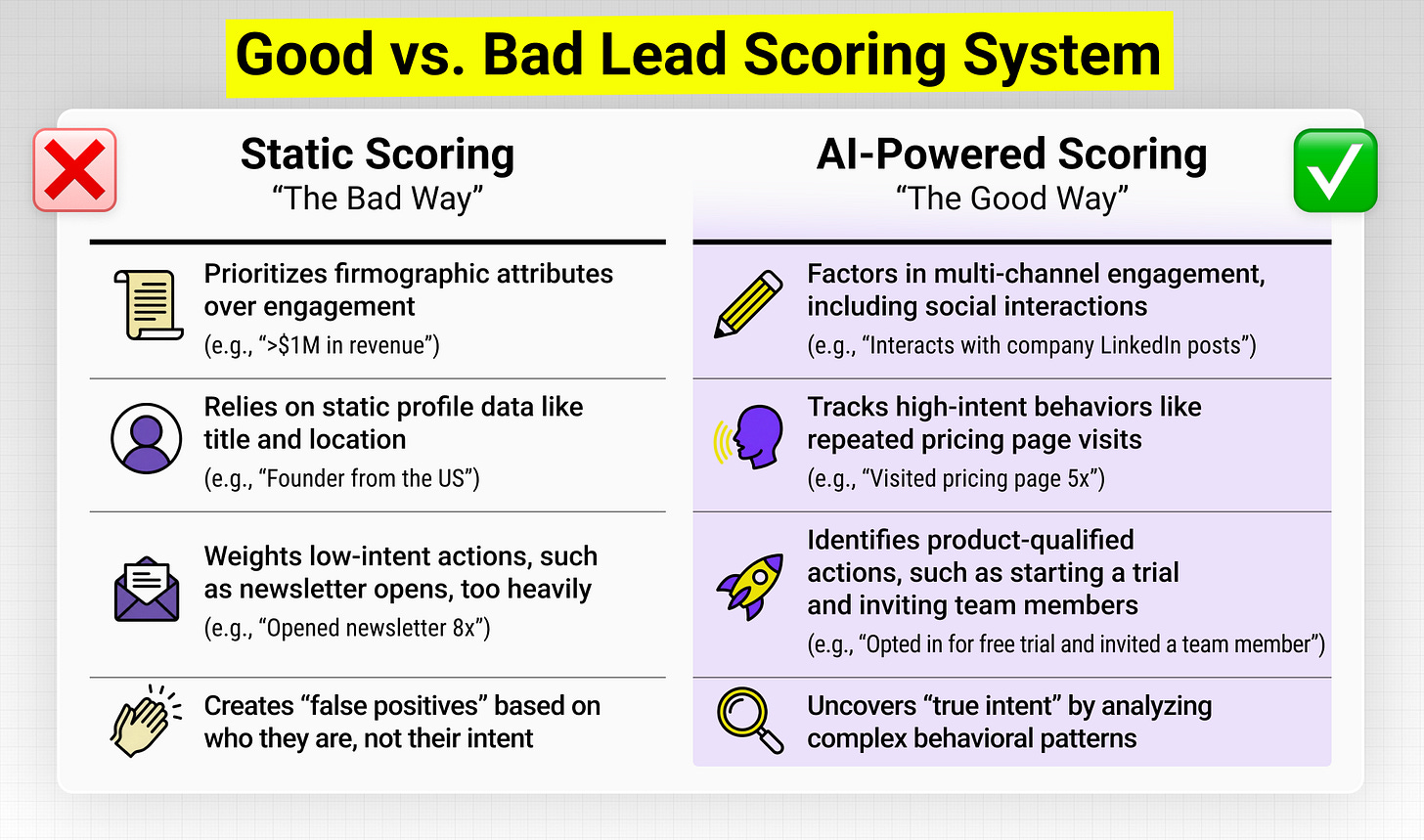

What criteria to use for scoring: AI-Proof Lead Scoring Systems

For lead scoring in 2026, we need to move past tracking clicks and downloads. That level of measurement stopped being useful years ago.

With AI, it’s now much easier to spot trends and find new patterns to identify our best future customers, and eventually transform your lead scoring system into a dynamic model, not a static calculation.

For an effective lead scoring system, you need to add multiple layers of signals - here’s are the most common examples:

1. Contextual Fit (The Foundation)

Contextual fit is the foundation. Classic firmographics like company size, industry, and geography still matter, but they’re just the baseline.

What GTM teams really want to know is whether an account makes sense right now. That includes things like technical compatibility and existing toolstack - signals that tell you whether they can even use your product.

One of the most revealing signals? Current solution status. Companies using outdated competitors are prime displacement opportunities. Companies with no visible solution are greenfield opportunities. Companies that just implemented a strong competitor? Probably not worth your time right now.

Modern CRMs like Attio do a fantastic job by automatically enriching basic lead data with this information, so you can immediately proceed with lead scoring. For technology data, you can use Attio’s AI research agents.

Key signals to track:

Company size (employees/revenue)

Industry and geography

Technology stack compatibility

Adjacent tool usage (signals they’re in your ecosystem)

Technology adoption patterns (early adopter vs laggard)

These signals don’t make a lead a high priority on their own, but they confirm the account belongs in your universe.

2. Behavioral Momentum (The Engine)

Momentum is where prioritization actually happens. The biggest mistake in traditional lead scoring is treating every action as equal. A single login or a click doesn’t mean much.

What momentum actually looks like:

Single pricing page visit = 5 points

Three pricing page visits in 48 hours = 25 points (active evaluation mode)

Watched 80% of product demo + pricing visit + case study download = 40 points (serious buyer behavior)

Teams look for depth of usage, activation of sticky features, and repeated engagement over time.

Website engagement signals:

Pricing page deep engagement (5+ minutes or multiple visits)

Case study downloads in their industry

“Product vs Competitor” comparison page visits

ROI calculator usage

Multiple unique visitors from same company (buying committee activation)

Product usage signals (for trial/freemium):

Daily active usage vs one-time login

Feature adoption beyond basics (3+ features used)

Integration attempts during trial

Crossing usage limits or thresholds

Content consumption signals:

50%+ open rate on email sequences

Multi-stakeholder opens (different people from same company)

Webinar attendance and engagement

Internal email forwarding (they’re sharing your content)

The pattern you’re looking for is frequency + depth, not just volume. Someone who visits your pricing page three times in two days is showing more intent than someone who downloaded five e-books over six months.

3. Intent and Timing (The Trigger)

This is where most teams get lead scoring wrong. They focus only on what prospects do on their website and miss the external signals that indicate a company is ready to buy right now.

Company trigger events create buying windows - moments when budget opens up, new leaders want to prove impact, or operational pain hits a breaking point.

Growth & Funding Signals:

Recent funding rounds (0-18 months): Series A/B/C indicates budget and urgency. Companies that just raised are in expansion mode and actively buying tools.

Rapid hiring surge (30%+ team growth): Scaling fast creates process breakdowns and urgent need for new solutions.

New office locations or geographic expansion: Multi-location complexity = new tool requirements.

Product launch announcements: New initiatives require new tooling and infrastructure.

Leadership & People Signals:

New C-level or VP hires in target functions: New leaders have 90-day windows to prove impact. They’re actively looking to make changes and show results.

Job postings for roles that use your solution: Hiring indicates growth in that function and signals they’re investing in capabilities you support.

Promotions into leadership roles: Internal promotions also create momentum for change and new tool adoption.

Champion job changes: Your power users at other companies moving to new orgs (track these people - they’ll buy again).

Technology & Competition Signals:

Technology stack changes: When companies add complementary tools, they’re in active buying mode.

Competitive tool removal or contract changes: Displacement opportunity windows when competitors are being evaluated or removed.

Competitor renewal dates: If you can find these, it’s your best timing window to reach out.

Market Events:

IPO preparation or going public: Creates compliance, scalability, and reporting needs.

M&A activity (acquiring or being acquired): Integration creates tool consolidation pressure.

Regulatory changes affecting their industry: Creates compliance tool needs.

Why these signals matter: They answer the question “Is this the right moment?” A perfect-fit company with great engagement might not buy for six months. But a perfect-fit company that just raised a Series B and hired a new VP of your target function? That’s a now opportunity.

4. Revenue Potential (The Prioritization Layer)

Here’s the layer most teams miss entirely: predicted deal size.

Without this, all “good fit + high engagement” leads look equal. But a $200K opportunity deserves different resources than a $20K opportunity.

Why this matters:

Account executives need to know which deals to prioritize

Marketing needs to know where to invest ABM budget

Your team can’t allocate effort properly when every lead just shows “Score: 85/100”

How to calculate revenue potential:

For seat-based pricing (most B2B SaaS): Estimated Annual Value = (Target Team Size × Monthly Price × 12)

Example: B2B Sales Tool at $100/user/month

150-person GTM team = 150 × $100 × 12 = $180K predicted ACV

75-person GTM team = 75 × $100 × 12 = $90K predicted ACV

25-person GTM team = 25 × $100 × 12 = $30K predicted ACV

Add growth multipliers for higher accuracy:

Recent funding (Series A+): ×1.2 (they’ll grow the team)

Fast hiring velocity (50%+ YoY): ×1.15

Multiple office locations: ×1.1

Complete example:

Base: 100-person GTM team × $100/month × 12 = $120K

Recently raised Series B: ×1.2

Fast growth signals: ×1.15

Final predicted value: $166K ACV

Your sales team should see “$166K opportunity” in the CRM, not just “high value score.” This makes prioritization decisions obvious.

Bring it all together: Dynamic AI-Powered Scoring System

Instead of baking this formula into your CRM (or head in some cases), and considering it done, think about it as a dynamic system that constantly evolves. Why? Best in class GTM teams do not use a single score “Bobness”, they use multiple scoring systems that need to be revised as your market and GTM changes. They are not chasing perfection from the first iteration; they let it learn and enhance it with AI, pattern recognition, and machine learning.

Create v01 and iterate on it to become more accurate, but don’t settle on some lazy thinking like “founders from the US with more than 2 million revenue that like your LinkedIn post” - you can do so much better by integrating more intelligence into the mix that will help you make better decisions.

The four-layer system in action

Layer 1 (Fit): Are they in your ICP?

Layer 2 (Behavior): Are they engaging with your brand or product?

Layer 3 (Triggers): Is now the right time to buy?

Layer 4 (Value): How much revenue potential?

Example prioritization matrix:

Champions (High Fit + High Behavior + Active Trigger + High Value): $180K ACV, engaged daily, just raised Series B → Your A+ accounts, get AE involvement immediately

Hot Timing (High Fit + Medium Behavior + Active Trigger + Medium Value): $80K ACV, moderate engagement, new VP hired → Strike while timing is hot

Nurture (High Fit + Low Behavior + No Trigger + Medium Value): $90K ACV, low engagement, no trigger events → Keep warming until trigger appears

But as always, the hard part isn’t defining signals.

It’s making them visible, adaptable, and actionable.

That’s why teams increasingly rely on flexible CRM systems like Attio with built-in lead scoring:

multiple attributes instead of rigid lead objects

views tailored to different GTM roles

scoring logic that can evolve without re-architecture

AI agent that researches the web to bring more data for lead scoring

My team created this short tutorial on how to create lead scoring workflow in Attio that will help you implement this system in your sales process using their workflows - no coding.

With the Segment integration, you can also bring product usage data into Attio and incorporate product-related, behavioral signals into lead scoring.

The bottom line: Lead scoring in 2026 isn’t about counting clicks. It’s about layering fit, behavior, timing, and value into a system that tells your team exactly where to focus their energy.

Build it, test it, iterate on it. Your calendar (and your revenue targets) will thank you.

Cool - hope you enjoyed this one.

Hit a heart if you did ♥️, ask questions in comments, and send it to a team member who should implement this to make it truly actionable.

And if you like what we talk about here, there is SO MUCH more actionable content, templates, and workshops available in my GTM Strategist solutions.

Happy lead scoring 🤘

Maja

✅ Need ready-to-use GTM assets and AI prompts? Get the 100-Step GTM Checklist with proven website templates, sales decks, landing pages, outbound sequences, LinkedIn post frameworks, email sequences, and 20+ workshops you can immediately run with your team.

📘 New to GTM? Learn fundamentals. Get my best-selling GTM Strategist book that helped 9,500+ companies to go to market with confidence - frameworks and online course included.

📈 My latest course: AI-Powered LinkedIn Growth System teaches the exact system I use to generate 7M+ impressions a year and 70% of my B2B pipeline.

🏅 Are you in charge of GTM and responsible for leading others? Grab the GTM Masterclass (6 hours of training, end-to-end GTM explained on examples, guided workshops) to get your team up and running in no time.

🤝 Want to work together? ⏩ Check out the options and let me know how we can join forces.

Hi Maja, thanks for sharing! Great post! We are researching how to build a lead scoring engine based on Clay as data hub which integrates different data sources and export to a CRM top scored accounts to be followed by a SDR. Does it make sense compared to your approach?

Does Attio allow you to set up all the parameters mentioned for lead scoring, so it can pull in publicly available information about the company, the contact, etc.?

All the parameters you mentioned sound very reasonable and important, the main question is how to automate this.

I don’t have a live project to test Attio on right now, and it’s not completely clear from the trial.