Experiment More, Grow More: 3 Steps You Must Know

Insights from my $5K growth hacking presentation

This post is supported by Amplitude, a leading analytics platform for product and marketing teams. They shared 5 case studies with actionable examples of how companies have prepared fruitful organizational, cultural, technological, and analytical systems to support rapid experimentation and growth. Get Amplitude’s Guide to Growth here.

Dear GTM Strategist!

In this Substack, you will learn:

The secret behind exponential growth rates

Why most organizations fail to launch even 3 experiments a week

Why you must create a “single source of truth”

Why silos are the hurdles you should tackle immediately

How to start running your experimentation process

Let’s G(r)o(w)! 🚀

(and prepare a fruitful terrain to scale in 2025 🧑🌾)

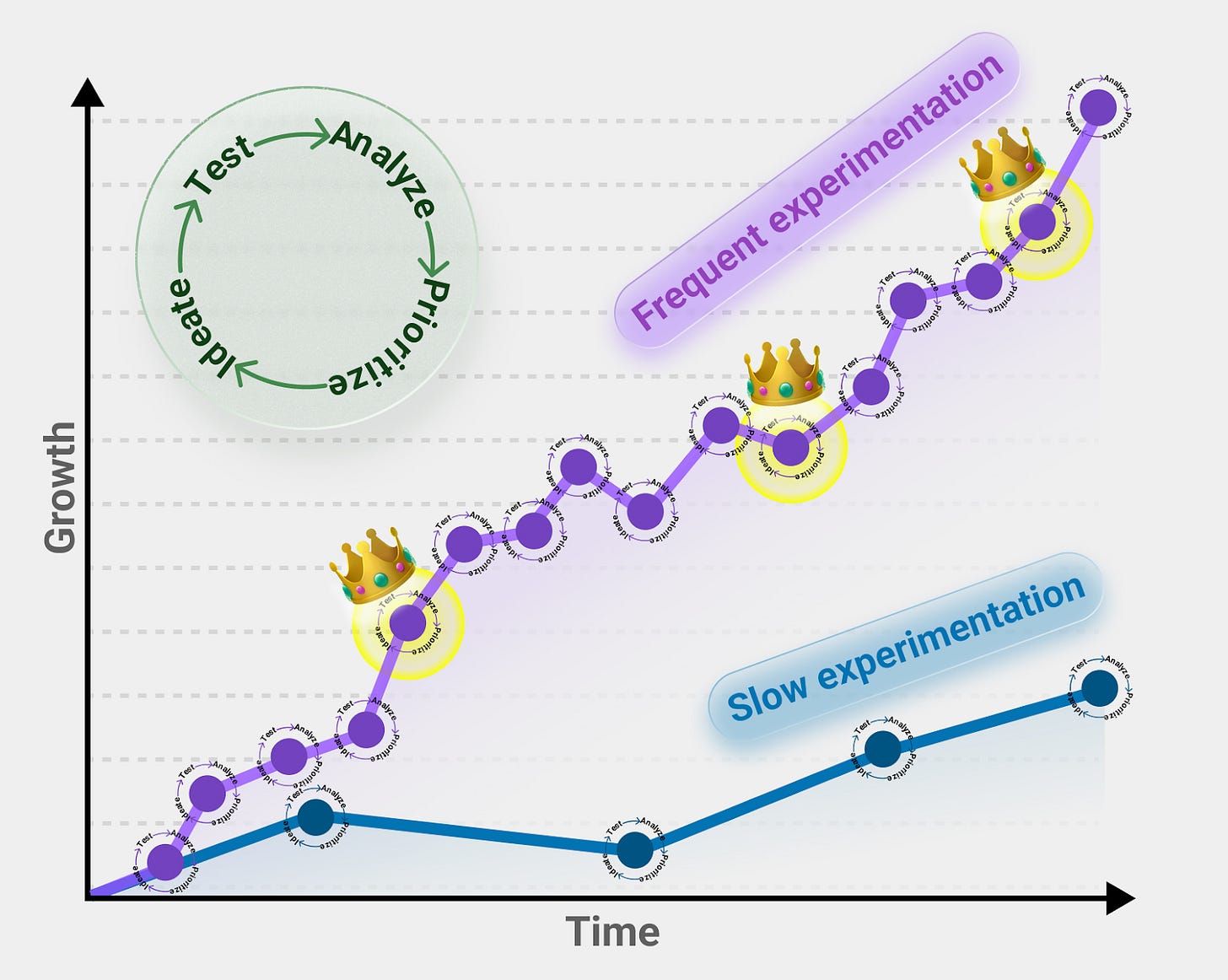

The faster you experiment - the quicker you grow

Jeff Bezos famously said in one of his shareholder letters:

“Our success at Amazon is a function of how many experiments we do per year, per month, per week, per day.”

Best-in-class companies, such as Amazon, Netflix, and Meta, run thousands of experiments every single day. If we open the Uber App now, each of us will likely see different versions of it as a result of different experimentation buckets.

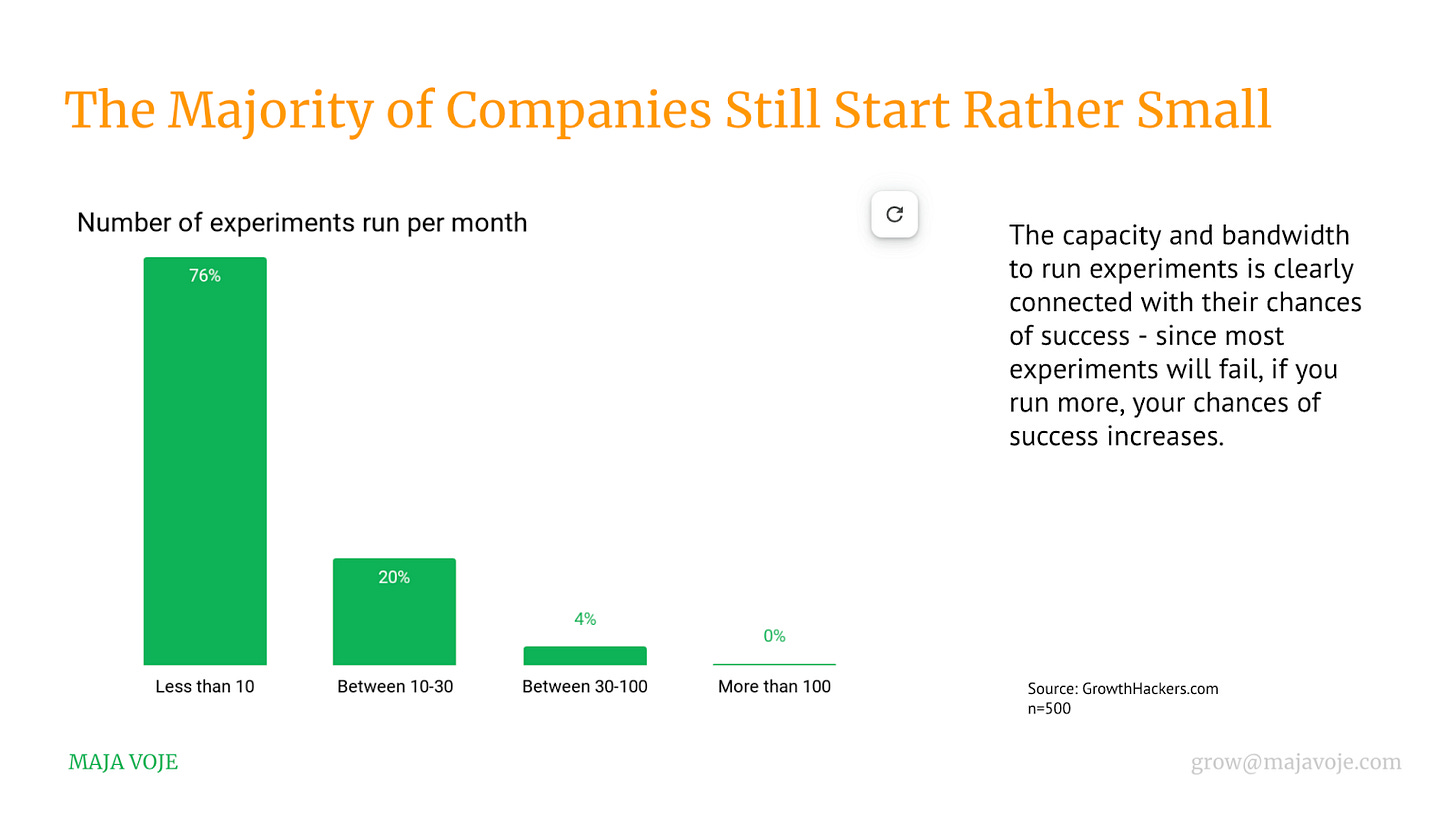

Yet, most organizations run less than 10 experiments a month, which is less than 3 a week.

Now, ask yourself this:

If the average success rate of the growth experiments (taking conversion rate optimization experiments as the benchmark) is 10-20%, how many wins should you produce to impress your boss, teammates or yourself with the experiment’s results? 🤷

I know in some cases a low velocity of experiments is justified.

For instance, if you operate with a small data set, it could prevent you from running statistically significant tests. Then, your experiments are almost as good as guessing.

But you can still experiment by turning to qualitative research. Some intelligence is always better than no intelligence.

Most growth coaches advise you to focus on the number of insights generated in the early stages of your GTM. This can mean doing more interviews and surveys for customer validation. However, I encourage you to presell or at least get letters of commitment with recommendations because

people say < people do

(confidence = evidence)

Rapid experimentation is a good thing. The BIG QUESTION is:

Why do most companies fail to experiment fast (enough)?

Let’s investigate three possible reasons and find ways to overcome them. ✌️

(spoiler: no one lacks ideas for experiments)

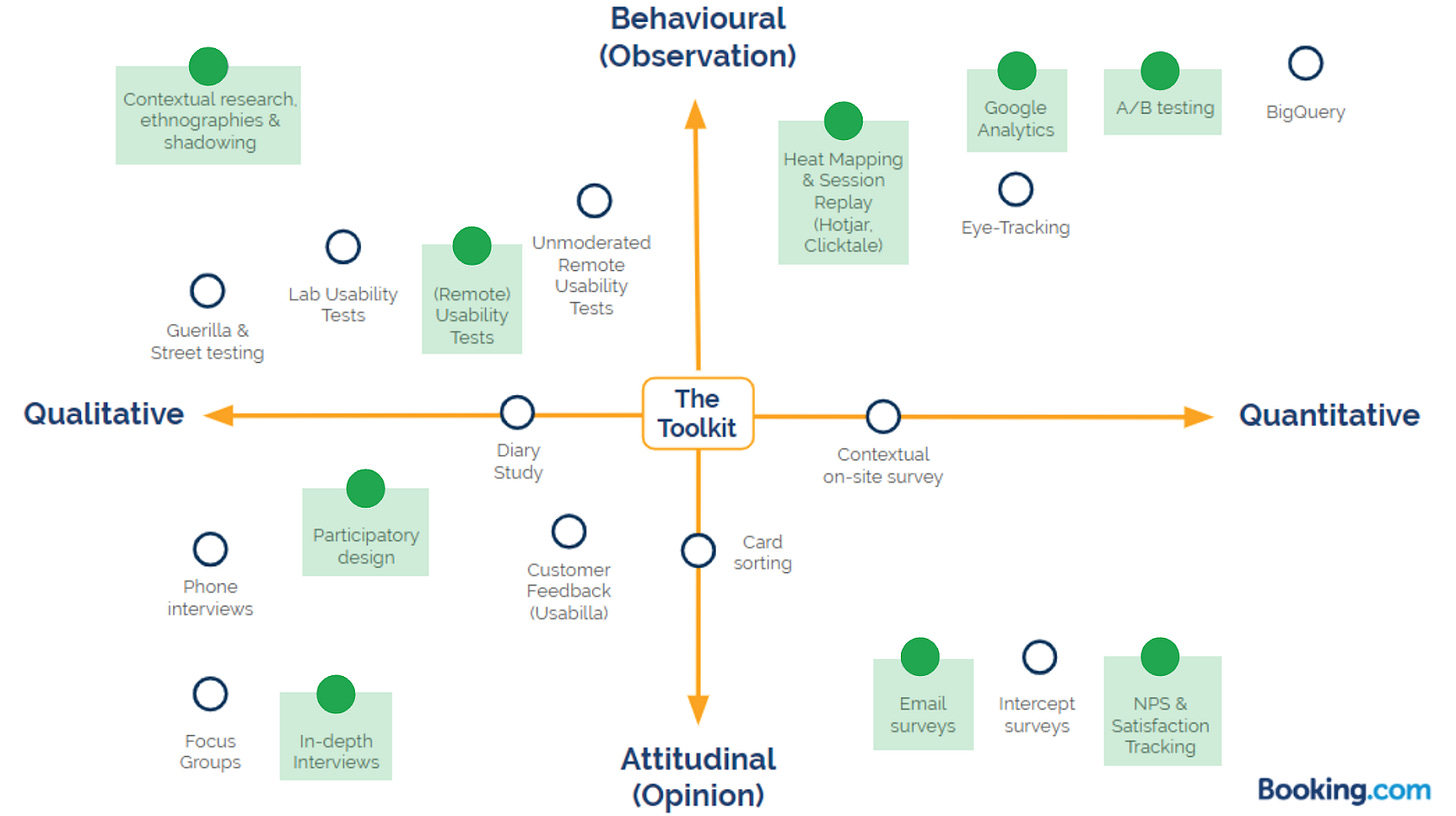

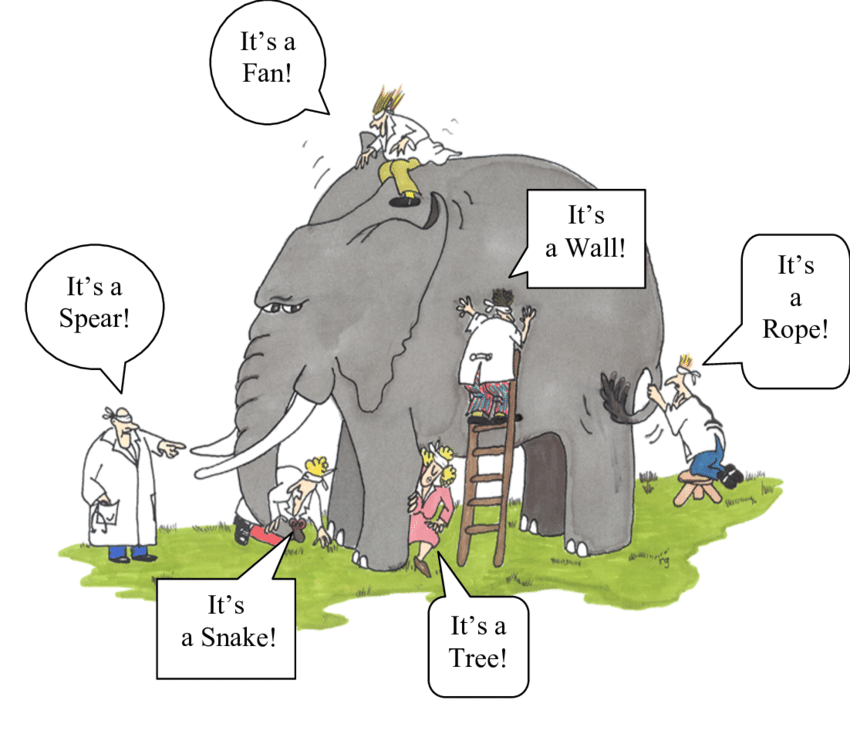

1) 🐘Look for a Single Source of Truth

The larger the organization, the more likely you’ll find its people trying to identify business challenges and opportunities in a disconnected way. It’s like a bunch of blindfolded people attempting to identify an animal by touch.

One of my scaling clients (bagged +$40million funding) told me:

“A company is a truth-seeking entity.”

In this quest for truth, companies must ideally look for a “single source of truth”. But usually, this is an aspiration, not a reality.

The reality consists of many fragmented views, data sources and software that produce trackbacks, vendor-reported metrics, and expert opinions.

There are multiple versions of truths flowing through multiple streams. This creates confusion and misalignment of efforts.

For instance, you’ll have different challenges to answer the question: Why is the ROI low on this campaign?

💥 Shit - the influencer did not use the UTM link

💥 The conversion metrics between Meta Business and Google Analytics are different

💥 For some reason, there are more activated than registered users 🤯

How to make sense of this?

The only solution is to agree on an analytical system, which fetches data from multiple systems, and implement it across the organization. People must look at the same data in real time.

For analytics, I like to work backward - first, I create a mock-up of the dashboard I would like to see as a decision-maker. Next, I connect different data streams to the dashboard to centralize decision-making intelligence.

2) If a Metric Does Not Impact Your Behavior - Delete it!

The FOMO associated with the approach of “we should measure everything” has its right place in backend processes, not in a dashboard that I use for intelligence in my decision-making.

Here are some metrics that B2B SaaS often use to guide their go-to-market efforts:

1. Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR)

Why it matters: These metrics are the cornerstone of SaaS financial performance, providing a clear picture of predictable, recurring income.

What to track: Track new MRR, expansion MRR (upsells), contraction MRR (downgrades), and churned MRR to understand the dynamics of your revenue growth.

2. Customer Acquisition Cost (CAC)

Why it matters: CAC quantifies the cost of acquiring a new customer, helping evaluate the efficiency of sales and marketing investments.

What to track: Divide the total costs of acquiring customers (e.g., marketing spend, sales team expenses) by the number of new customers acquired during a specific period.

3. Customer Lifetime Value (LTV)

Why it matters: LTV helps measure the long-term profitability of a customer, offering insights into the value of your user base and justifying your CAC investments.

What to track: Calculate LTV by multiplying the average revenue per user (ARPU) by the customer lifespan, while factoring in churn rates.

4. Churn Rate (Customer and Revenue)

Why it matters: Churn measures the rate at which customers or revenue are lost, providing insight into the health of customer relationships and the value of your product.

What to track: Monitor both customer churn (percentage of customers lost) and revenue churn (percentage of revenue lost), ideally separately for gross and net churn.

5. Net Revenue Retention (NRR)

Why it matters: NRR reflects the total revenue retained from existing customers, accounting for renewals, upsells, cross-sells, and churn. High NRR (above 100%) indicates that your business can grow revenue without relying solely on new customer acquisition.

6. Pipeline Velocity

Why it matters: This metric shows how efficiently leads move through the sales funnel, from initial interest to closed deals, offering a snapshot of sales effectiveness.

What to track: Combine the number of qualified leads, win rate, average deal size, and sales cycle length.

7. Product Engagement Metrics

Why it matters: SaaS companies need to know if their product delivers value. Metrics like activation rate, feature adoption, and monthly active users (MAU) indicate how well customers engage with the product.

What to track: Identify key usage metrics tied to value delivery, such as time-to-value or the percentage of users reaching onboarding milestones.

8. Sales Efficiency (e.g., Magic Number)

Why it matters: Sales efficiency KPIs show how well your sales and marketing efforts translate into revenue growth. The Magic Number compares the increase in ARR to sales and marketing spend.

What to track: A Magic Number above 1 indicates efficient sales growth.

9. Customer Satisfaction Metrics

Why it matters: Happy customers are more likely to renew and advocate for your product. Metrics like Net Promoter Score (NPS) and Customer Satisfaction (CSAT) provide qualitative insights into the customer experience.

What to track: Regularly survey customers to gauge satisfaction and identify improvement areas.

10. Cash Runway and Burn Rate

Why it matters: For SaaS startups or scaling businesses, cash flow management is critical. Burn rate and cash runway indicate financial health and sustainability.

What to track: Monitor monthly operating costs and remaining capital to project how long the business can operate without additional funding.

Tracking these KPIs provides B2B SaaS companies with the insights needed to drive growth, optimize operations, and foster customer loyalty, ensuring long-term success.

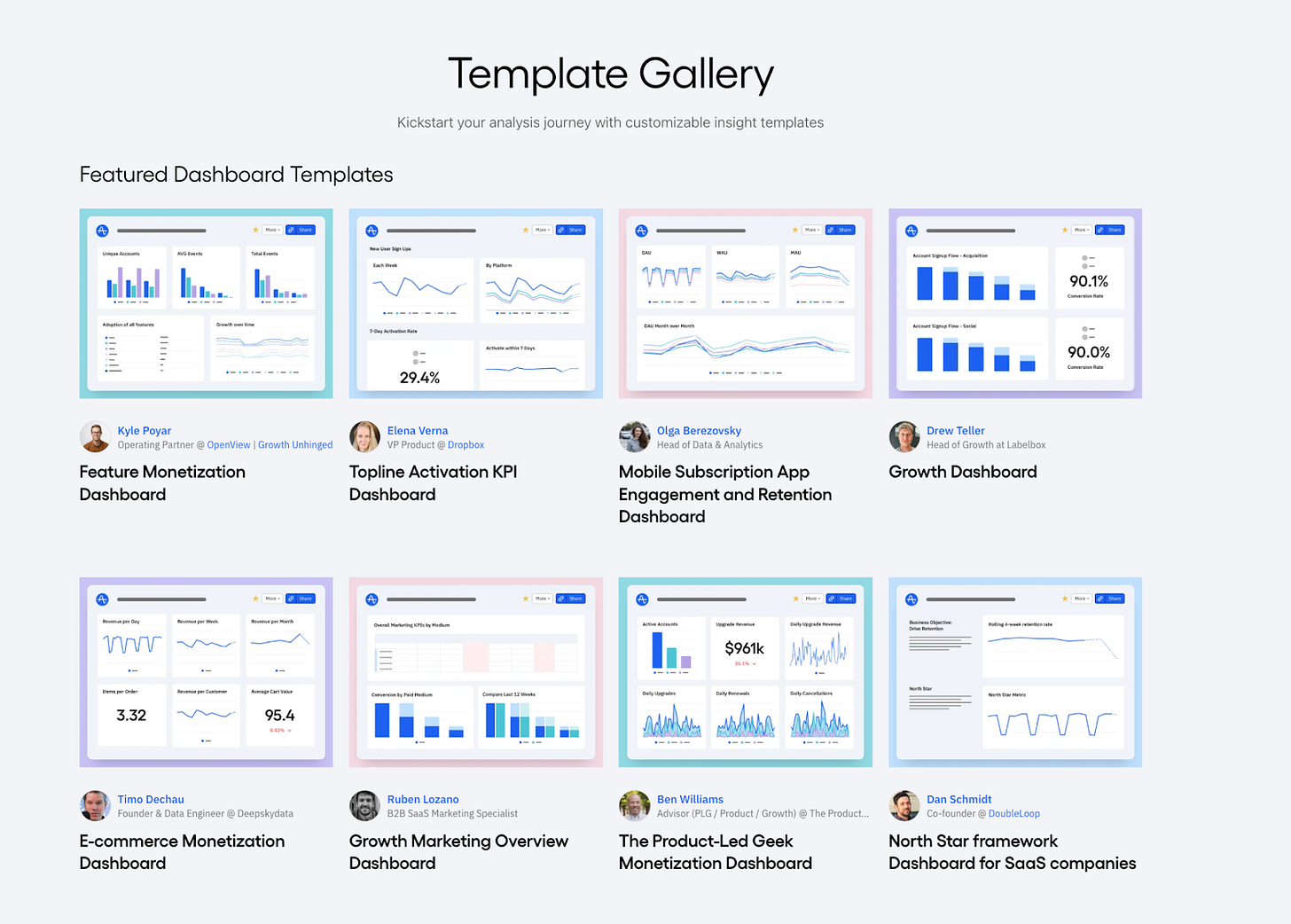

Beginner: If you don’t know which metrics to display on your dashboard, check out this beautiful moodboard for inspiration. Growth and product legends such as Elena Verna, Kyle Poyar, Ben Williams, Leah Tharin, and many other experts have pitched in with FREE templates for almost any tech product business model you can think of.

PRO: If you want to learn how digitally mature companies grow revenue more quickly, this new Guide to Growth by Amplitude is for you. It offers actionable best practices and real-world insights from global organizations like Appfire, SafetyCulture, MoEngage, Unity, and more. With nearly 70% of digital transformation initiatives failing, these lessons provide a practical roadmap to avoid the pitfalls.

3) 🌾Break the Silos 🔨: How to Organize a Team

After you secure a ‘single source of truth’ - you bump into another challenge - PEOPLE.

Who is responsible and who will do the actual work?

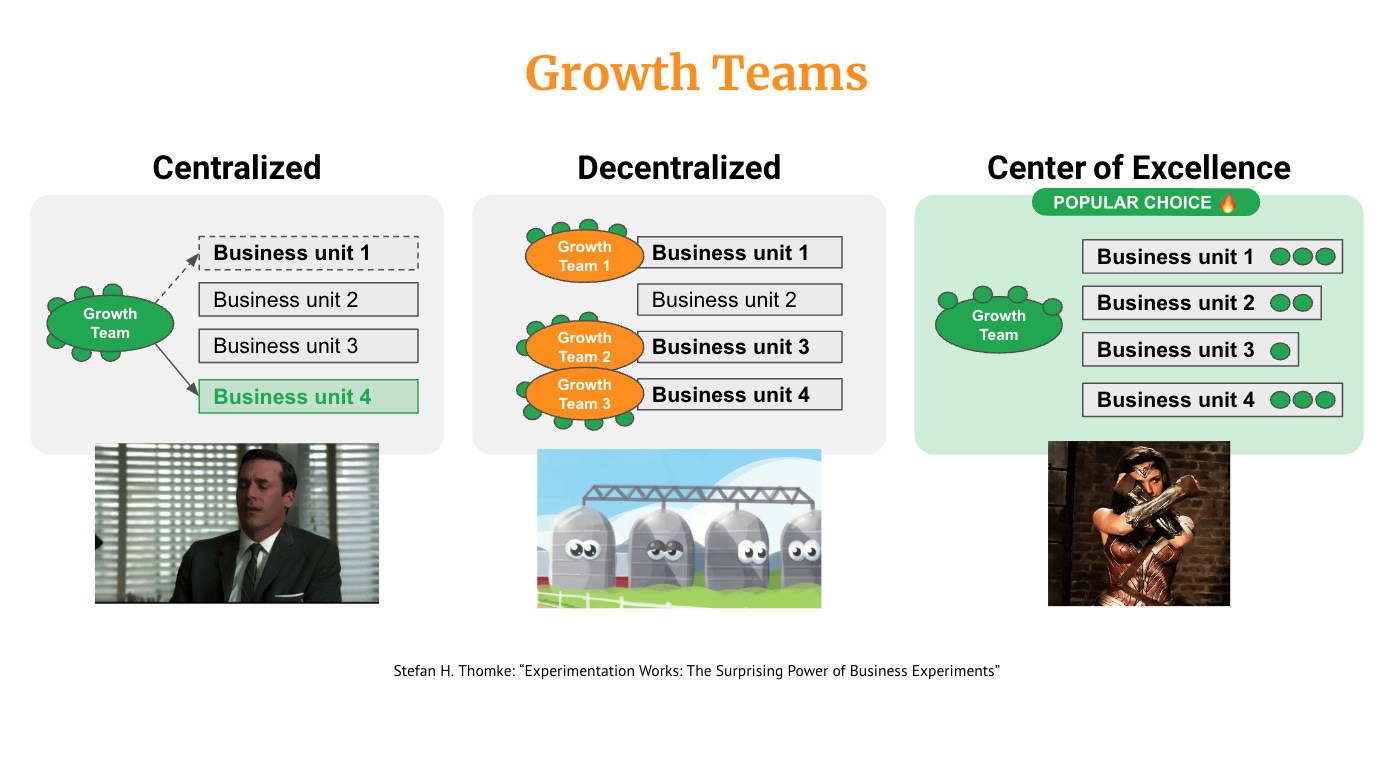

The larger organizations I work with have growth teams. They mainly pick from the three models:

Centralized aka internal agency: One growth team serving multiple business units

Decentralized: Multiple growth teams supporting different business units

Center of Excellence aka “team of teams”: You have a growth team as a standalone department serving different business units and formulating growth teams within them.

In even larger organizations, you have multiple growth teams specializing in different parts of the funnel such as acquisition, retention, and monetization. They operate as teams of teams.

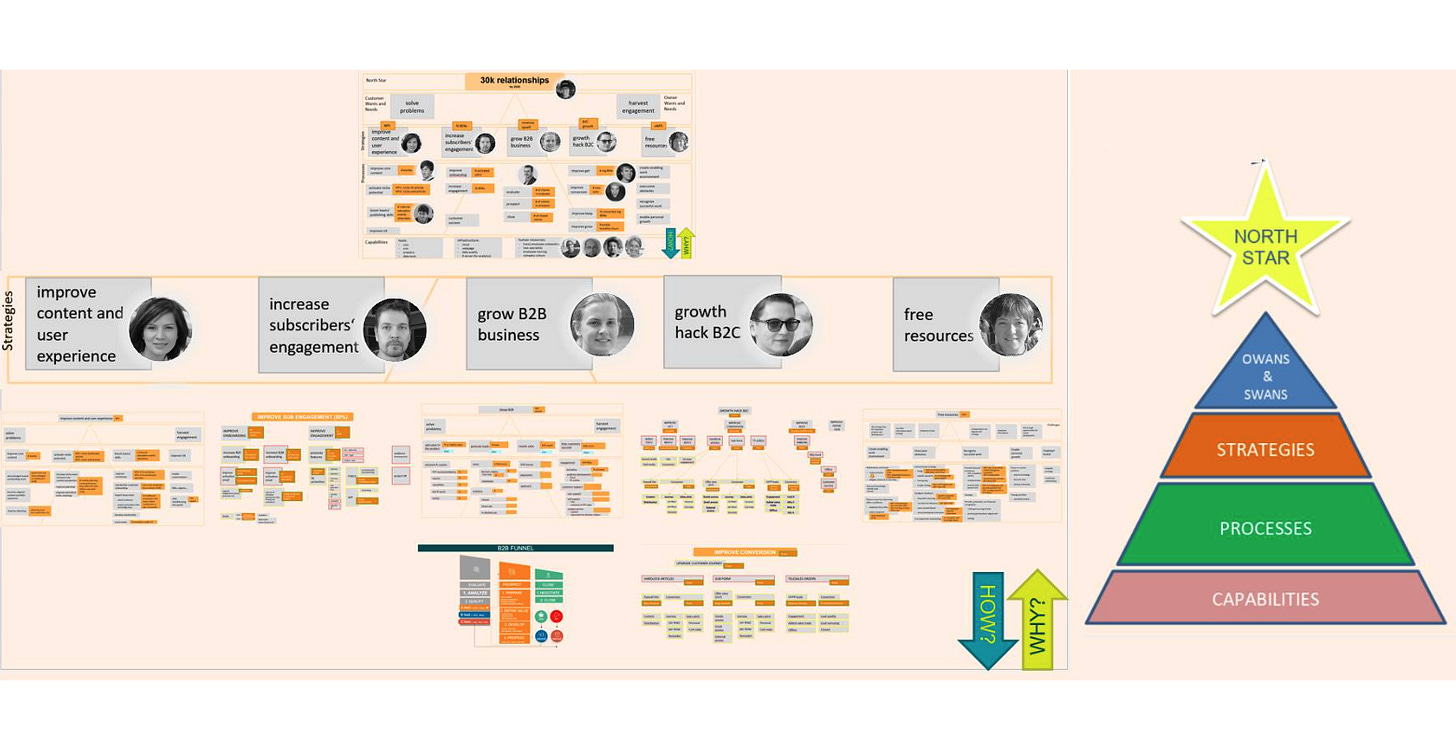

Below is an example of what a Center of Excellence growth team looks like for a finance media company.

I wish I could give you really clever HR-grade advice on who should be in the growth team,but my “street smart” answer is: Those who have the knowledge, respect, influence, and experience to get the work done + they share your vision of a culture of experimentation.

However, you must assign people to growth teams only after modifying their OKRs and rewards to reflect that. Otherwise it could demotivate them.

Still, we must address one more silo - vendors, freelancers and agencies. Companies seek external help with implementation, and these external agents create another silo. Ideally, you must work with vendors to achieve the company's goals.

But you and I both know that it’s hard to get external vendors (who are potential competitors) to work with each other.

The best you can do is to assign an external owner to agency relationships and compare their reports to the single source of truth you created to hold them accountable.

Most good strategies fail because of poor execution, not poor planning

Now you can have the best analytical system and the most competent and driven cross-departmental team. But the attempt to be a “data-driven and experiment-led growth machine” could still fail if it is not managed and executed properly.

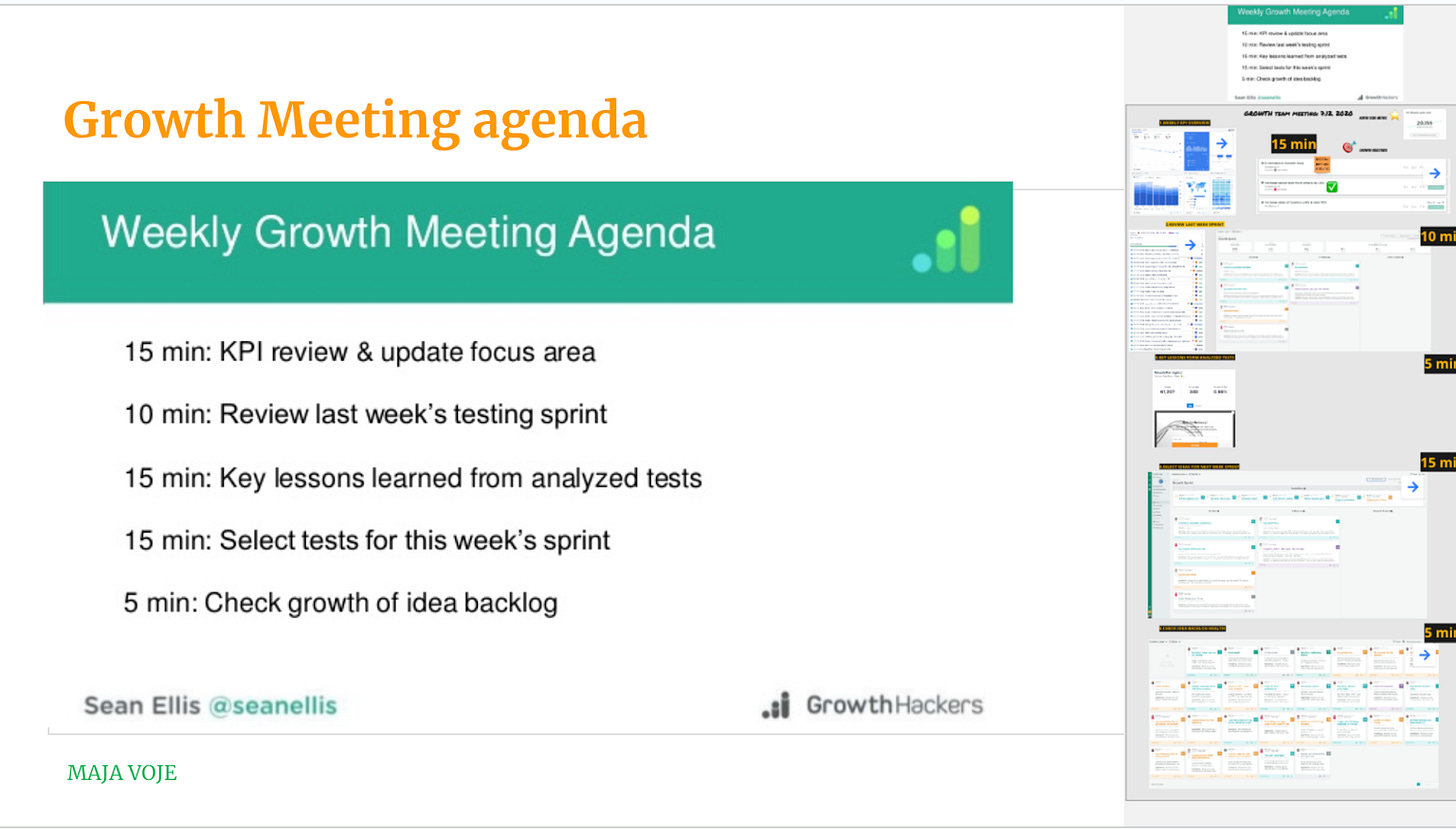

For that you need standard operating procedures(SOPs). Here are some of the best practices for plan execution I have seen on the field, largely influenced by Sean Ellis’s teaching 🙏:

Agree on North Star Metric

Determinate quarterly or monthly objectives (a maximum of 3, if you are new to this)

Select a growth team (comprising leads, platform specialists, channel specialists, and analysts)

Make the team work weekly or biweekly sprints

Create an experiment pool (backlog)

Agree on a prioritization method

Run a growth meeting (agenda below)

After that you do a retrospective meeting

Easy? No.

Worth it? Yes.

If you operate in a complex environment, you can’t bypass the issues of “being data driven” across vision, processes, and technology. See how 5 scaleup companies tackled this problem and built healthy environments for experimentations and unified digital experience for their users.

🍭 Goodie bag

Yesterday, I launched an MVI - minimal viable idea 🤠of our first attempt of LMS (chatbot 🤖) I trained it on 1 million characters of my priority content - have fun breaking it!

My friends at SaaS Pricing issued a new 2024 AI SaaS pricing report. You can access it here for free: https://pricingsaas.com/benchmarksAI/

On Monday, 23 December, Product Management expert Jason Knight (One Knight in Product) and I will go live on LinkedIn and YouTube in our Christmas outfits 🧑🎄 - if you have some questions, hop on and we will make it interesting.

📘 New to GTM? Learn fundamentals. Get my best-selling GTM Strategist book that helped 9,500+ companies to go to market with confidence - frameworks and online course included.

✅ Need ready-to-use GTM assets and AI prompts? Get the 100-Step GTM Checklist with proven website templates, sales decks, landing pages, outbound sequences, LinkedIn post frameworks, email sequences, and 20+ workshops you can immediately run with your team.

🏅 Are you in charge of GTM and responsible for leading others? Grab the GTM Masterclass (6 hours of training, end-to-end GTM explained on examples, guided workshops) to get your team up and running in no time.

🤝 Want to work together? ⏩ Check out the options and let me know how we can join forces.

This article clearly highlights how strong the silo mentality blocks any creative efforts. As a marketer in a central marketing department It's hard to steer the direction of the company.

However, when a marketer is hired in a business unit and cooperates directly with a leader, say general manager, than we can create miracles :)