Are You Leaving Too Much Money on the Table?

SaaS margins dropped from 90% to 50% with AI - what to do about it

This post is supported by Schematic — monetization infrastructure for modern SaaS and AI companies.

Schematic helps product and growth teams turn usage into revenue without rewriting application code every time pricing or packaging changes. Define plans, entitlements, limits, credits, trials, and exceptions once — then iterate fast as you learn.

Teams use Schematic to improve trial-to-paid conversion, unlock expansion, and avoid revenue leakage as products, pricing, and GTM evolve.

If you care about shipping growth experiments without billing becoming the bottleneck, Schematic is worth a look.

Dear GTM Strategist!

Every founder regularly asks themselves if they should raise their prices.

They also have board members, investors and advisors ask the same questions.

Ultimately, it’s a question of missed opportunity and lost value.

How much money are we leaving on the table?

With AI models embedded in products, pricing has never been more interesting but challenging. This was my exact conversation with a well-known startup founder (let’s save his face):

Maja: “But I have no idea what I’m getting for those 5000 credits.”

Him: “I know it is difficult to understand, but our 10 top users were burning like 80% of our AI usage fees so we had to turn to credits.”

Maja: “I get that, it sucks, but as a potential buyer, I still don’t know what package will cover my use cases and what value am I getting for those credits.”

Him: “Well, that depends on what you want to do, features burn credits differently.”

Maja: “Okay, I understand. Can you at least try to tell me how much it would cost me if I want to do X action with 2000 accounts? I love you and your product, but it is not my job as a buyer to do the pricing math. It is your job as a founder/seller.”

This isn't just my experience. While experts have been raving about outcome-based and usage pricing, the reality is that most B2B buyers want some predictability - and blaming them for being “old school” will not help us move more products.

What else do we want as founders? Predictable revenue.

Hybrid pricing has been grossly underrepresented in the AI star wars of searching for the latest and greatest. But it is a perfect bridge between where we are and where we wanna go.

In this article, I want to bring you some valuable tools to help you make these decisions:

The “wirecutter” guide to modern pricing models with examples

How to conduct willingness to pay research - aka “pricing therapy” interview with 8 questions to ask

Anatomy of a great pricing page

If you are as puzzled and frustrated by “credits” in pricing as I am, and you value predictable costs as a buyer, I promise you’ll love this one.

This is a practical summary from Fynn Glover’s book, You’re Leaving Money on the Table, that I have hand-crafted for you. You can download the book for free - it takes <1h to read, and it’s packed with useful insights and models that will help you get to the pricing model that makes both you and your customer happy.

It features insights from top pricing and business experts, including:

Gaurav Vohra, Growth Leader at Superhuman, Advisor at Clay, Replit & others

Kyle Poyar, Founder, Growth Unhinged

Madhavan Ramanujam, Author of Monetizing Innovation

Shar Dara, Head of Billing at Vercel

Tido Carriero, Cursor, ex-founder & CEO, Koala, and fmr. VP, Segment

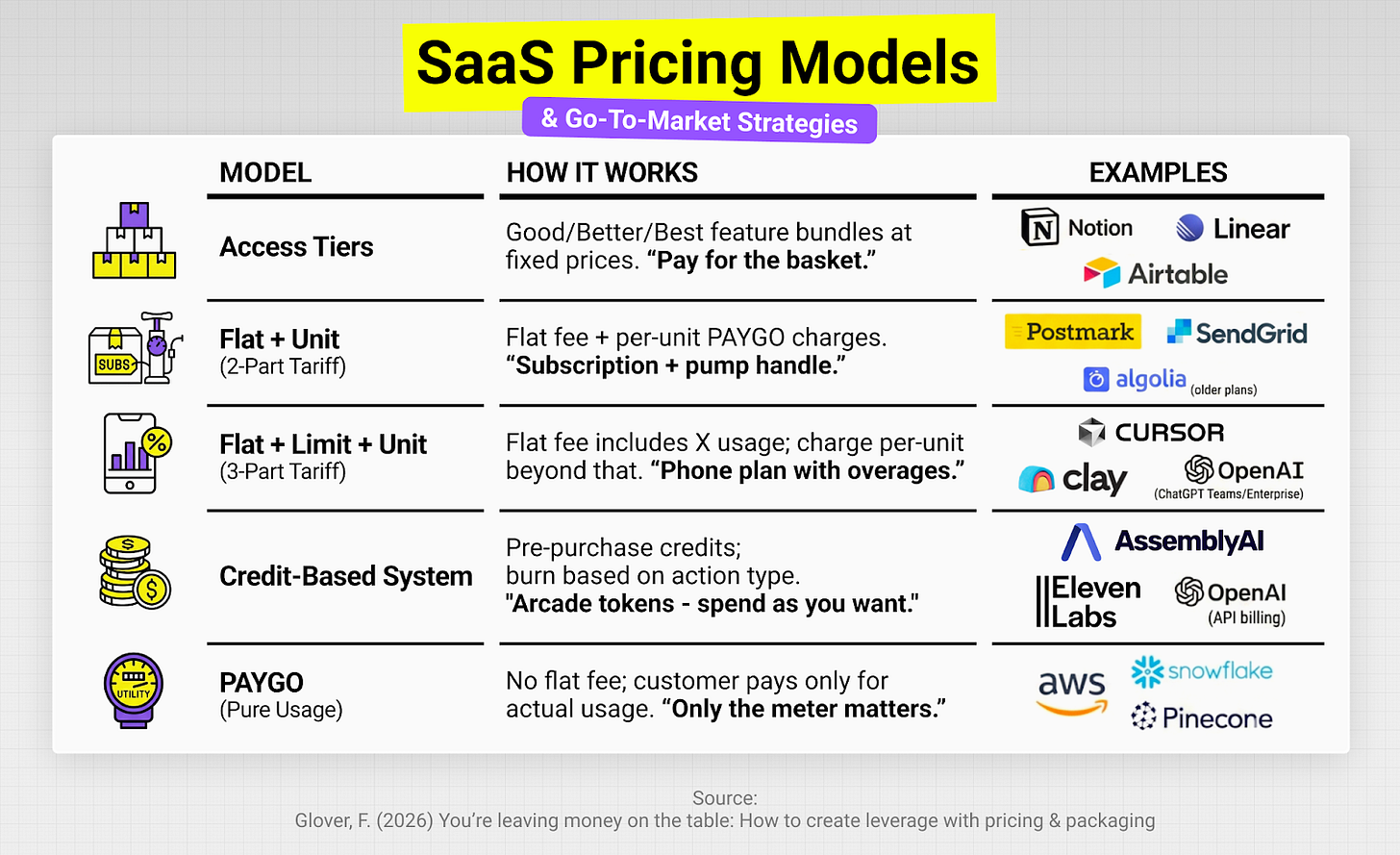

The “Wirecutter” Guide to Modern Pricing Models

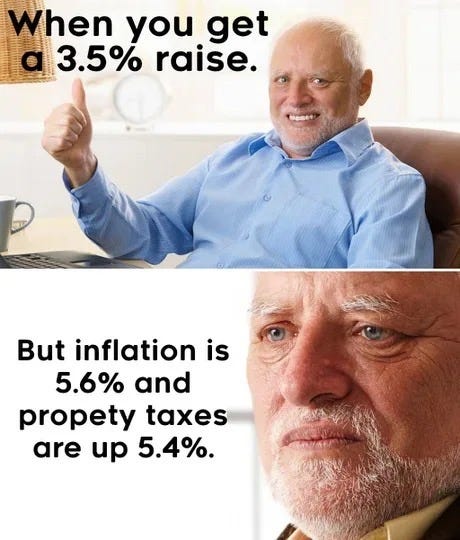

“It was simpler to price SaaS before AI for one structural reason: you were selling applications with deterministic workflows and predictably high 80-90% gross margins. This made it safe to sell flat-rate, seat-based pricing,” explains Fynn in his book.

What happens when you’re selling probabilistic workflows, buy AI credits from other vendors, and have unpredictable 50-60% gross margins? Since most companies can’t price on “outcomes” alone due to the attribution problem, they end up with hybrid pricing models.

I am prioritizing this section because I know exactly how most of us will tackle pricing:

“Oh, cool - a company X does Z - they are great - should we follow that example? :)”

I am the same - show me the end goal to motivate me to do the heavy lifting.

So before really going into pricing research, which is non-negotiably great for you to do, let’s see what feasible pricing models are for you to consider.

These models are the best available proxy, based on what the product can do, what the customer perceives, and the value the vendor can objectively attribute to its product/service/agent.

This explosion of new models makes it harder than ever to know which one to choose.

Your job is to pick the least wrong one for your product and then iterate continuously as your product matures, your competition matures, and as you learn from your customers and salespeople.

If you want to get a detailed 4-step guide on how to choose the right pricing model for you and many more assets, you can download the You’re Leaving Money on the Table book.

Now for the hard part: validation. Those models mean nothing if your customers don't understand or value them. In the next section, you will learn how to test before you launch.

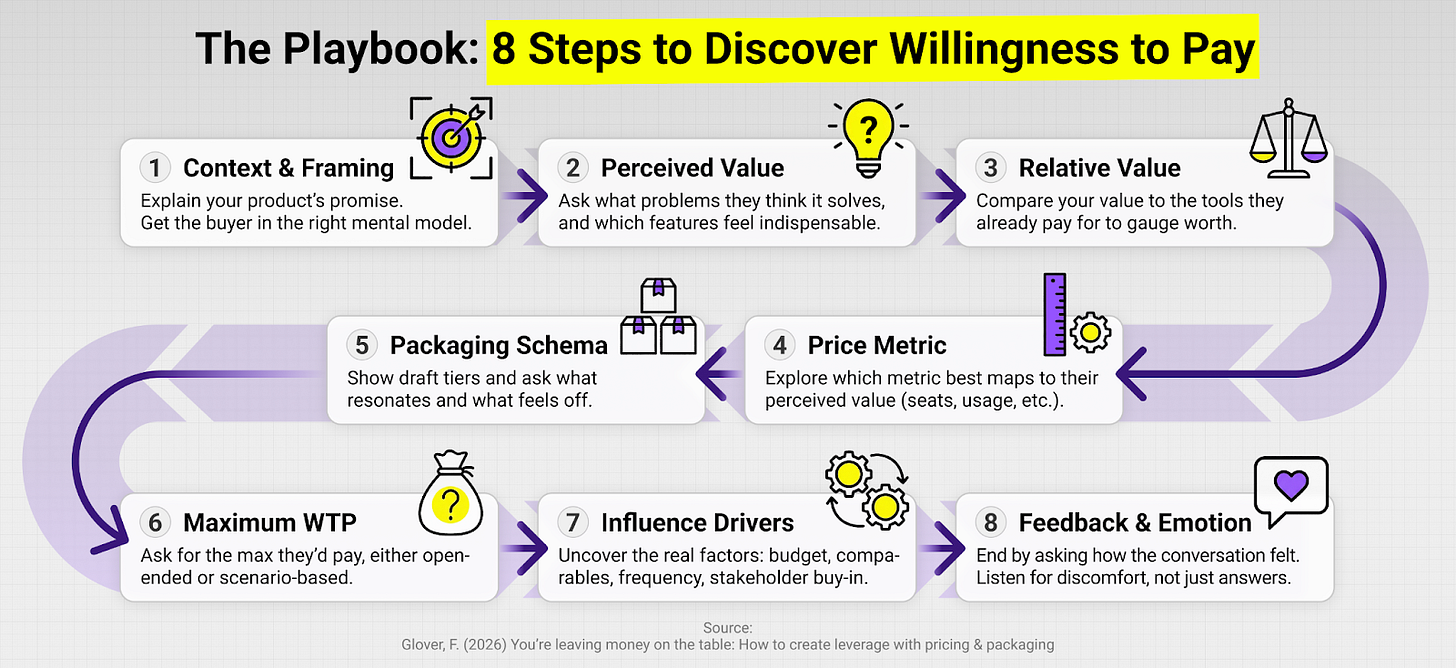

8 Steps to Discover Willingness to Pay, aka Pricing Therapy

Fynn Glover, CEO of Schematic, believes, and I agree with him, that being able to talk to customers about willingness to pay is arguably the most critical tool in a founder’s toolbelt for finding & accelerating Product-Market Fit (PMF).

Conducting PMF conversations should never stop. They should occur when you’re pre-product, after you’ve won initial customers, and then on an ongoing basis as you extend and deepen your PMF.

Over the last 2.5 years, Fynn has done countless WTP interviews with customers. But he’s also trained hundreds of founders on WTP, so they are equipped with the vocabulary of pricing and packaging and are confident in their ability to position and sell their pricing.

Here is a repeatable flow of questions you could ask customers, prospects, or design partners in under an hour:

Make sure the delivery is conversational, not static. This is what you need to align:

Clarity: Do you understand what value you create and how to express it?

Confidence: Can you deliver your price narrative with confidence, poise, and persuasion?

Consistency: Does every team inside your company tell the same story?

If those aren’t aligned, the model doesn’t matter. You’ll lose deals, underprice, or discount out of insecurity.

And before we go-go for this week, I want to leave you with one more super useful framework from the “You’re Leaving Money on the Table” book, which is…

Anatomy of a Great Pricing Page

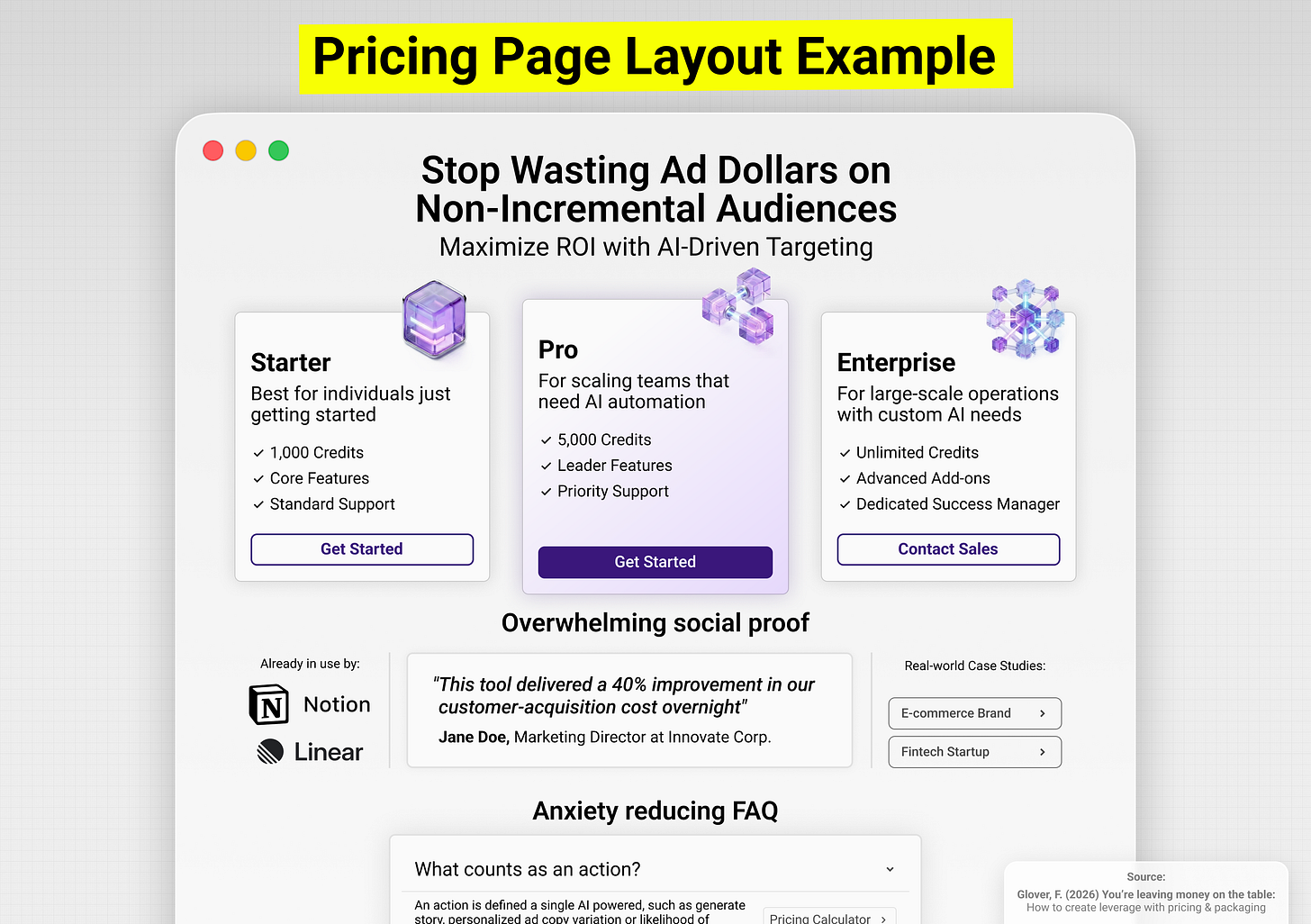

The final step is to communicate your new model to the world. Your pricing page is your GTM strategy, made public. While specific designs change, the best pricing pages all share four key components:

A clear, re-stated value prop: The page must start with a confident headline that reminds the user what problem this product solves for them.

Clear tiers & price metric: The user must be able to self-identify which tier is for them and what they are likely to pay over time.

A good FAQ: This is where you handle all the “what if” anxieties. “What counts as an ‘action’?” “What happens if I go over?” “Can I roll over credits?” Answer these proactively so they don’t have to ask sales.

Overwhelming social proof: This is your final chance to de-risk the purchase. Use logos, testimonials, and case studies to prove that people just like them are already getting massive value from this.

Something like this:

Hooray … we made it 🥁 Thanks for sticking with me - pricing is not easy, but it is the only GTM element that directly makes us money - others spend it 😀 so we should be paying close attention to it and definitely avoid the “set it and forget it” pricing tactics.

Here are the next steps to take to make sure you apply what you learned today:

Grab a free version of the book - <1h to read - min. 4 tangible takeaways 💪 or send the link to a colleague who is thinking about launching a new AI product in Q1 so that they will not end up leaving a bunch of money on the table. They’ll be grateful.

✅ Need ready-to-use GTM assets and AI prompts? Get the 100-Step GTM Checklist with proven website templates, sales decks, landing pages, outbound sequences, LinkedIn post frameworks, email sequences, and 20+ workshops you can immediately run with your team.

📘 New to GTM? Learn fundamentals. Get my best-selling GTM Strategist book that helped 9,500+ companies to go to market with confidence - frameworks and online course included.

📈 My latest course: AI-Powered LinkedIn Growth System teaches the exact system I use to generate 7M+ impressions a year and 70% of my B2B pipeline.

🏅 Are you in charge of GTM and responsible for leading others? Grab the GTM Masterclass (6 hours of training, end-to-end GTM explained on examples, guided workshops) to get your team up and running in no time.

🤝 Want to work together? ⏩ Check out the options and let me know how we can join forces.

Regarding willingness to pay, especially in the enterprise and highly regulated world, where any variability quickly raises yellow flags, based on my experience, this transition would require a clear top-down disruption.

It is not only about better pricing conversations, but about breaking through organizational inertia and the internal burden that often prevents companies from translating rich, “deep” insights into consistent, data-backed pricing decisions.

A thought-provoking reflection. Happy to find!

It made me think about whether hybrid models are a natural response to change in the face of AI cost uncertainty, or whether they can truly establish themselves as a value-anchored pricing choice.

When inference costs become more predictable, will pricing metrics naturally simplify, or has complexity already become part of the package?